If only it were enough to participate… The Olympic performance of some hoteliers, such as Accor, was more than honourable. But the podiums remained inaccessible to other tourism athletes, including European airlines.

Simply maintaining annual profitability targets was a record. The only holder of this feat, the British IAG, was awarded the only medal for stock market growth in the sector (+21% in euros since January 1). All the other major players, including Ryanair (-17.35%), were disqualified by the decline in their shares.

The post-Covid normalization is only just beginning. Pressures on tariffs, while far from seriously denting pandemic inflation, are putting the spotlight back on still-rising costs.

The concentration, which has halved the number of players in the United States in twenty years, would be welcome. But European countries, adoring the implacable vice of double constraints, slow down traffic with one hand, and strangle mergers with the other, such as the aborted takeover of Air Europa by IAG.

This marathon that is run with lead shoes suits Air France-KLM, however. The Franco-Dutch company takes an option on the control of the Scandinavian SAS for 144.5 million dollars. Equivalent to that of a jumbo jet, this price allows it to protect its convalescent balance sheet. The amount of hybrid equity in fact exceeds its stock market capitalization, a trophy that its shareholders would gladly do without.

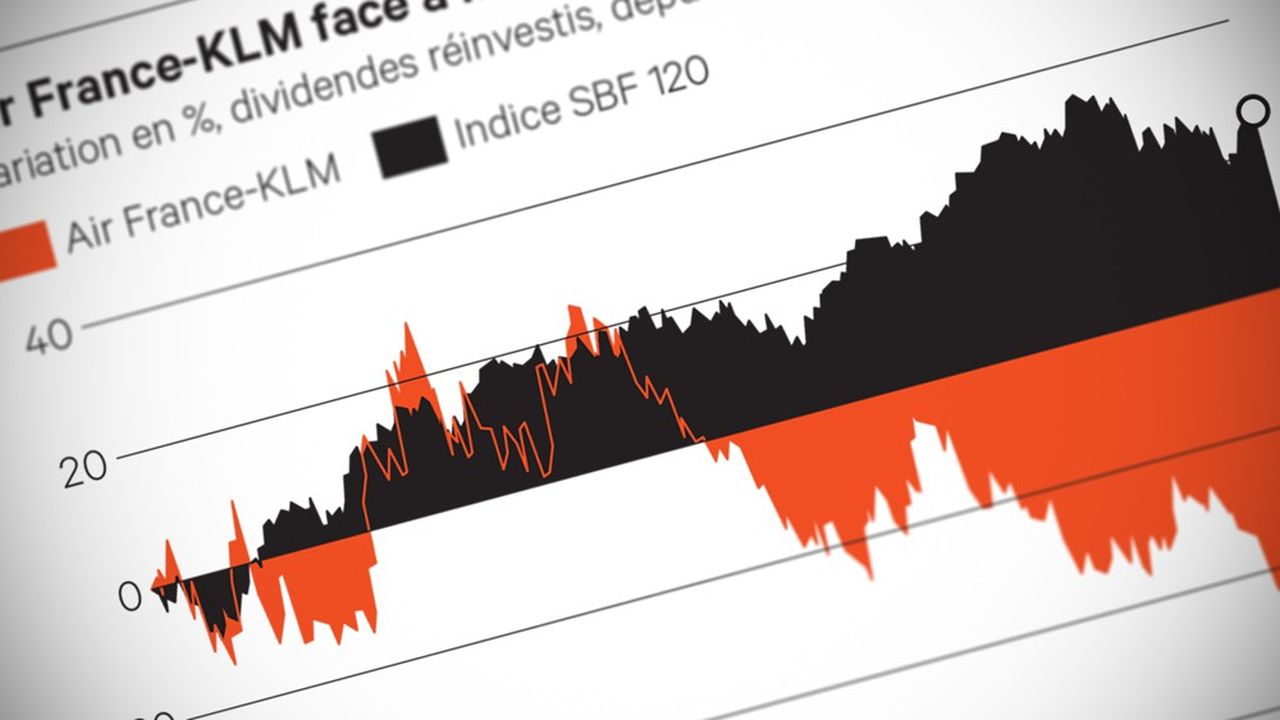

Air France-KLM shares versus the Paris Stock Exchange over two yearsBloomberg, Les Echos