Free tribune

As part of the draft budget for 2025, senators and deputies agreed on an enlargement of the loan at zero rate in all of France and houses, in new. Given the multiplication of promotional offers for banks, a free public loan in the old one seems less useful than it has been, concedes Henry Buzy-Cazaux, founding president of the Institute of Real Estate Services.

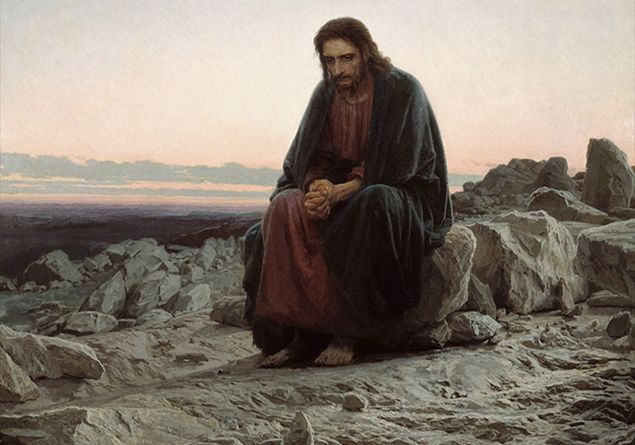

© Capital/Christine Lejoux

– A building from the 2nd arrondissement of Paris.

-

To safeguard

Saved

Receive alerts Zero -rate loan

It is two titles a turn that the 2025 budget of accommodation takes the resale market. First, for the first time for a long time, the zero -rate loanflagship aid for primary buyers-we will recall that they have formed before the crisis most of the buyers-excludes operations on existing goods with works. Furthermore, also for the first for many years, when the tax cost of a real estate transfer in France is among the highest in the world, now the departments are empowered by the finance law to increase for three -we know that the tax provision can become final …- transfer duties for consideration. Certainly, these rights also weigh on new purchases, but at a highly reduced rate, while it is confiscation in the old. Should we deduce, after seven years from a feeling of global real estate mesestime, that existing housing remains stigmatized?

No. The explanations are of another nature. Regarding the PTZ, it appeared that priority was to support new housing in all territories, for the collective as for the individual house. In addition, the public authorities still fear that assistance in the purchase of an existing housing will be recovered by the seller owner, who sets his price freely. We know that this fear is not unfounded. In the same logic, it can be estimated that the price of a housing requiring work may be the subject of a negotiation and a final price which resolvates the buyer, without intervention of public aid. As for the increase in what is improperly called notary feesit was conceded to the departments -which are the main recipients -that the drop in transactions of a third in the past two years had weakened, making them unable to face their very expensive social missions, for the little one Childhood, people with reduced mobility, the great age or the management of the RSA (active solidarity income). Again, we cannot exclude that buyers, who will spend on transfer rights € 500 more per price tranche of € 100,000, negotiate in due competition with the sellers and that this increase in taxation is neutralized.

Real estate: how prices will evolve in 2025 if credit rates go up (or stagnate)

Banks are increasing promotions in mortgage

In short, the adjustment variable of the price of existing goods, which cannot play in new -the price being fixed by adding production costs difficult to compress– Obviously makes direct aids to unnecessary, even dangerous buyers as soon as they can prevent price adjustments. We also see another phenomenon: the banksafter being afraid that the value of the assets they had financed abundantly for fifteen years would fall into a vertiginous way, come back in force towards the candidates for the acquisition. Promotions are increasing. The first real estate lender in France goes so far as to offer a 0% credit that can represent up to 10% of the overall price, it is true reserved for unpleasant housing, but also a loan of less than 2% for existing lessons less virtuous, calling for work. Under these conditions, A free public loan in the old seems less useful that it was … especially since if it had been free for the borrower, it would have cost hundreds of millions to the community (state compensation to banks between the market rate and the zero rate).

Moreover, the real estate agents And the networks of agents have a different link to the financial and fiscal public decision. During the professional conventions which stand these months, the stimulation of the troops prevails over the pleas in the government and the parliament. Professionals, aware that it is better to ensure a austere budget which guarantees a favorable look at the global markets on France and interest rates around 3% From this year, which generous measures breaking with the French deficit reduction trajectory. Clearly, professional transaction actors draw the forces to relaunch the market in them, preparing to accentuate their value add, more than they expect from the state any rescue. An illustration? The most recent convention of a national network, Imogroup, was held last week under a title which may seem singular in the midst of a crisis, “100% success”, and it sets the tone of the state of mind of the big ones signs of the residential transaction in the old one. You could say that the Coué method inspires them: not at all on reading the programs of such events: analyzes of the political and economic circumstances without concession by external experts, the point on the market shares won and lost, and a refocusing on the fundamentals of the profession, such as exclusive mandate, The use of all available tools, including artificial intelligence, or more committed partnership strategies.

Energy transition: the two France

Loss of 5,000 real estate jobs

In this context of deployment of contractacyclical energy, it is a safe bet that the penetration rate of professional negotiators, real estate agents or agent networks, will grow. This increase would be the normal corollary of conditions little readable for laymen and material to demonstrate their role for professionals. In addition, the mortality of 2,000 companies in this sector, leading the loss of some 5,000 jobsand the disappearance of more than 20,000 commercial agents, necessarily rebatts cards: they concentrate on fewer protagonists a market, certainly reduced, but in the process of redeployment. Those who remain feel the responsibility of de facto to take up the challenge and to gain in efficiency. Do not artificially help the old market will have an indirect virtuous consequence: driving the professional body to give the best of oneself.

Receive our latest news

Every week your appointment with Real estate news.