By Natacha Valla (Economist, Dean of the School of Management and Innovation at Sciences Po)

In Europe, productivity growth and R&D investment are lagging behind, particularly in the United States. Financing and growing innovative start-ups is more complicated there: we often regretfully see our most promising initiatives desert our territory to seek funding elsewhere, depriving us of both the direct benefits of their growth and the positive induced effects they generate.

And yet, innovation is a crucial state of mind to free us from existential anxieties around the deadly fear of downgrading and general disenchantment which leads to collective sadness, boredom and anger which are the bread and butter of populism.

Unfortunately, the issue of financing innovation remains a challenge. Market valuations are both a strength and a weakness. Internal resources are often lacking, and public policies are poorly understood.

Bond issues

Certainly, European start-ups and innovative companies have benefited in recent years from rapidly growing market valuations, while avoiding the pitfalls of excessive valuations, supported by significant capital flows, as studies by the European Investment Fund remind us. We all remember the rise of companies such as Klarna, the Swedish online payment unicorn, or BioNTech and its vaccines.

But these examples are too rare. The starting point is not completely unfavorable: dedicated financiers are few in number but dynamic.

Another key point: let’s not underestimate our companies themselves! When they have the means and are well managed, they deploy financial, organizational and human resources to innovate in their field, whether or not they are listed or open to external capital! The key? For the financial aspect, retention of profits or bond issues are necessary.

Diversify sources of financing

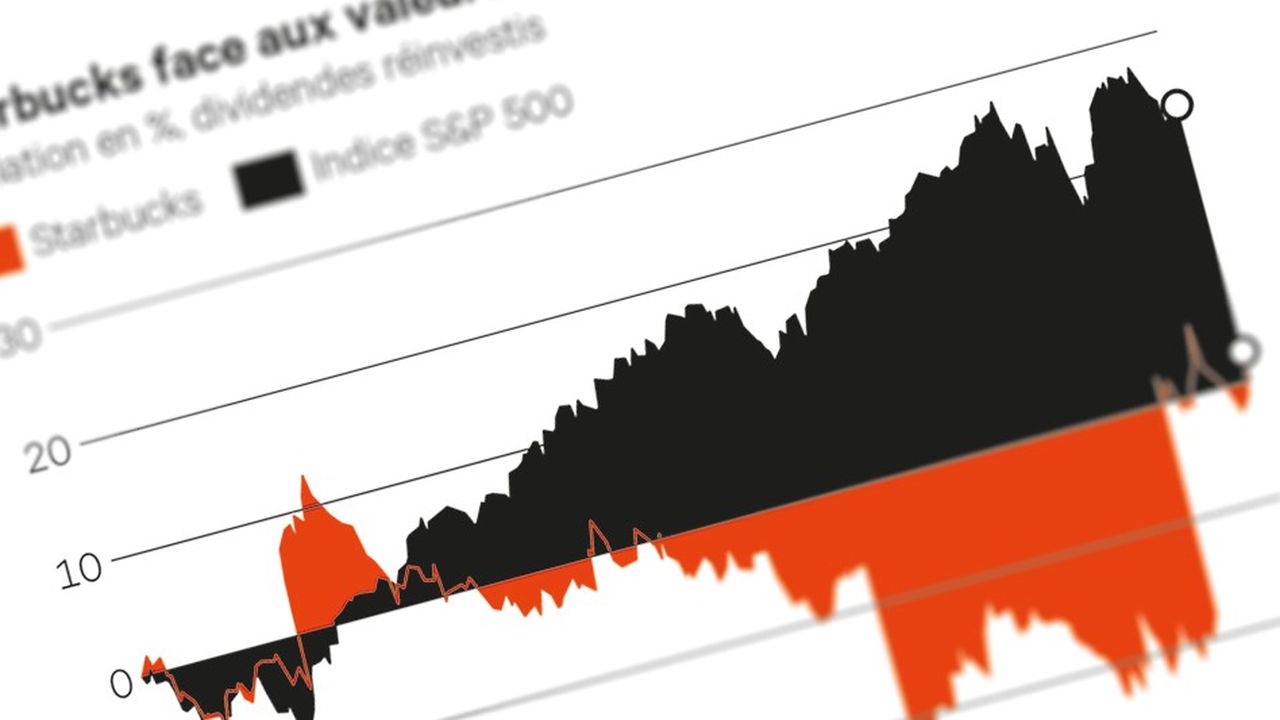

However, European companies are often less capitalized than their American counterparts. In these conditions, it is difficult to mobilize the same resources. It is also tempting to prioritize the payment of dividends or share buybacks in the short term: all costly decisions in terms of innovation or long-term development. The ingredients have been identified. How then can we encourage a more “optimal” approach to financing to promote innovation?

First, by strengthening valuation mechanisms in Europe. These must better reflect the fundamentals of companies, their profitability and sustainable viability, beyond the prospects of rapid growth in the short term.

Then, and only then, through public policies and funding. This includes supporting businesses at all stages of their development, as well as promoting a stable and predictable regulatory environment. Public investment banks and other initiatives such as the Horizon Europe or InvestEU programme are successful examples.

Finally, it is essential to diversify sources of financing, encouraging greater participation from institutional investors, sovereign wealth funds and capital markets. This diversification will not only broaden access to financing for a greater number of companies, but also spread risks more evenly across the European ecosystem.

Natacha Valla is an economist, dean of the School of Management and Innovation at Sciences Po