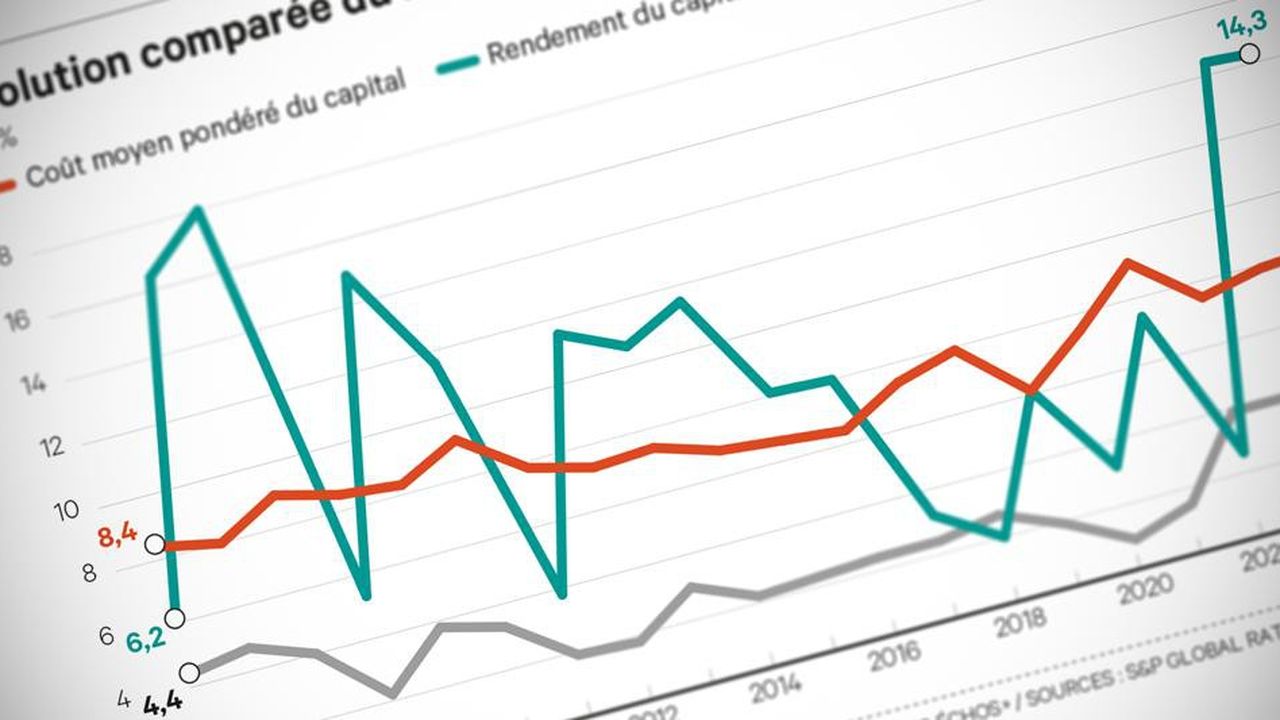

This “if” is a “big if,” but risk is their business. Global reinsurers’ profits should cover their cost of capital in 2024 and 2025, if natural catastrophes remain within budgets. This was the case in 2023 – for the second time in seven years, as shown in a chart by S&P Global Ratings – a year less heavy in very large claims (hurricanes, earthquakes) than the previous two.

The rating agency’s note released shortly before the annual professional meeting in Monaco does not just knock on the open doors of climate roulette. Because the insurers of insurers have been able to maintain better underwriting discipline for more frequent claims (violent storms). They also benefit from an increased return on their investments, the other pillar of these great hopes of value creation.