Rather than change in continuity, isn’t the continuity of change sometimes preferable? The stock market seemed to be demanding the second from Teleperformance’s CEO and founder, Daniel Julien, who had offered it the first. He was to spread out his succession over two years with his Indian number 2, Bhupender Singh.

Now that Saham, the new Moroccan shareholder of the world leader in customer relations, has satisfied their desire for renewal, investors, hardly happier (-6% for the stock in two sessions), are worried about its consequences, in this case the surprise departure of Mr. Singh, architect of a digital transformation in which they did not believe…

Since he signed the sale of Majorel last year by recovering, like his partner Bertelsmann, around 4% of Teleperformance, Moulay Hafid Elalamy, the founder of Saham, has seen the value of his stake halved. The fact that this former minister of the Cherifian Kingdom is concerned about it should have been reassuring. He takes over the presidency from Daniel Julien, brings back the former boss of Majorel, Thomas Mackenbrock, as deputy CEO, and sets up a real executive committee.

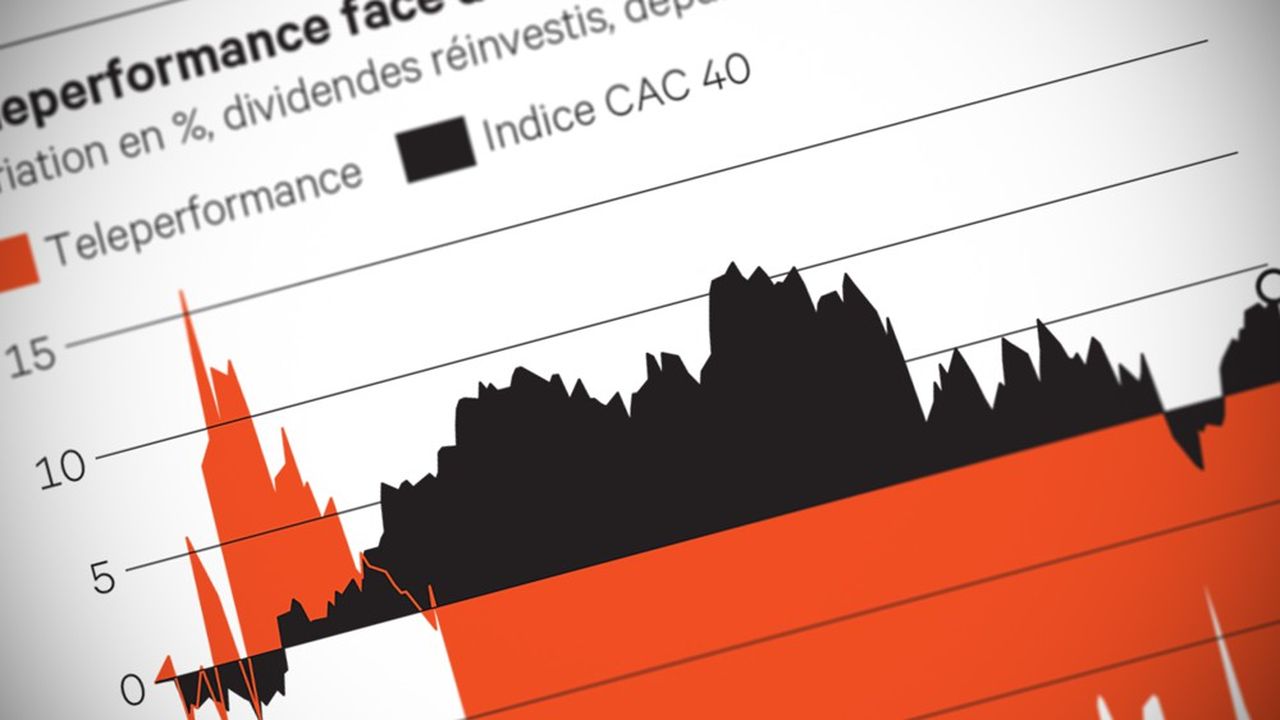

The timeframe for the handover between Julien and Mackenbrock as CEO is certainly not known. But with the stock having been divided by four since the peak in March 2022, time is money.

Teleperformance shares fell to a new low on the stock market in March with results and targets deemed disappointing.Bloomberg, Les Echos

Please note

The acquisition of Majorel was completed at the end of 2023 for 3 billion euros, of which around a third was paid in Teleperformance shares.

Majorel’s main shareholders, Saham and Bertelsmann, each received 3.6% of the capital of the world leader in call centers.

They made a commitment to hold their shares for twelve months from the closing (November 8, 2023). The agreement provided for a possibility of withdrawal after six months after this date, their participation becoming transferable in blocks of one third every three months.