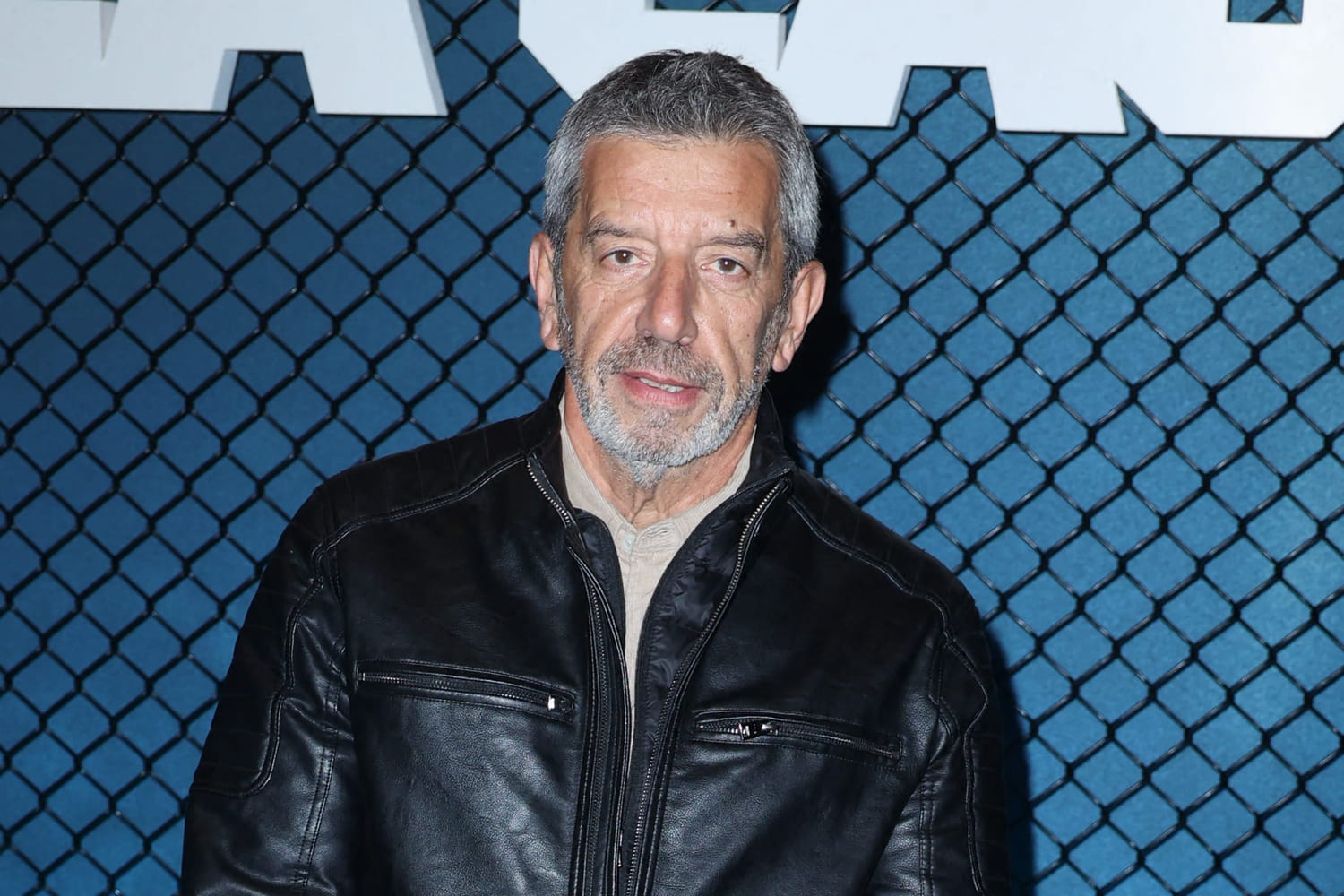

Stop for the return on euros funds? After rates of 2.65% and 2.60% distributed in 2023 and 2024, average remuneration could be more around 2.50% in 2025, according to the first estimates of the Facts & Figures firm. On the one hand, the decrease in the rate of booklet A – main competitor of life insurance in euros funds – and the fact that insurers have already drew massively from their reserves in recent years plead for a less generous rate in 2025. But on the other, insurers will not be able to descend too low, because they must continue to collect to increase the yield of their bond pocket, and to face other competing investments. Explanations with Cyrille Chartier-Kastler, founder of the Facts & Figures cabinet.

With the decline in inflation, the yield of risk -free investments decreases. Will this also be the case for euros funds in 2025?

Cyrille Chartier-Kastler: Insurers are taken between two contradictory injunctions to fix the rate that will be distributed to savers. On the one hand, inflation has dropped, as is the rate of booklet A, which increased to 1.7% on August 1. However, these are factors that would indeed lead to rather reduced the yield of euros funds compared to 2024 and 2023. We could say that a rate around 2% would for example be sufficient to compete with booklet A. But on the other hand, the key indicator of the yield of euros is the evolution of the OAT rate at 10 years (French State obligation at 10 years, editor’s note). However, the latter is maintained at a high level due to the financial and political situation of France. Currently, the OAT appears at 3.52%, but I would not be surprised that it rises up to 4.20% this fall, especially if the note of France were to be degraded.

Insurers have drawn from their reserves in recent years to avoid a drop in the rates served. Will this be the case too this year?

According to our calculations, the provision for participation in the profits of the sector (PPB, a return reserve that the insurer can use to smooth rates distributed from one year to another, editor’s note) would stand at 3.89% on average at the end of 2024, against 5.50% at the end of 2022. Also, some insurers still “under the foot”. But the raison d’être of a reserve is never to be fully consumed, and the PPB still decreased well, because to serve an average rate on average in 2024, the sector had already drawn massively from its reserves.

Given these elements, what is your forecast for the average return on euros funds served in 2025?

For the financial year 2025, we rely on an average rate hypothesis around 2.50% for euros funds, which would already correspond to a very large effort of insurers, because the yield of general assets (the financial portfolio of insurers, editor’s note) increases very slowly. Most still have a stock of bonds much less remunerated than at present. Thus, they always need to collect to subscribe to bonds with better return, and for that, they must display an attractive rate. In particular, it will be necessary to take the comparison with the term account offers which will undoubtedly flower in 2026, with yields boosted by the increase in bond rates. Also, insurers will have no interest in distributing less than 2% for the year 2025.

>> Our service – Test our life insurance comparator