Murka Completes Management Buyout to Remove Execution Friction and Reclaim Strategic Control

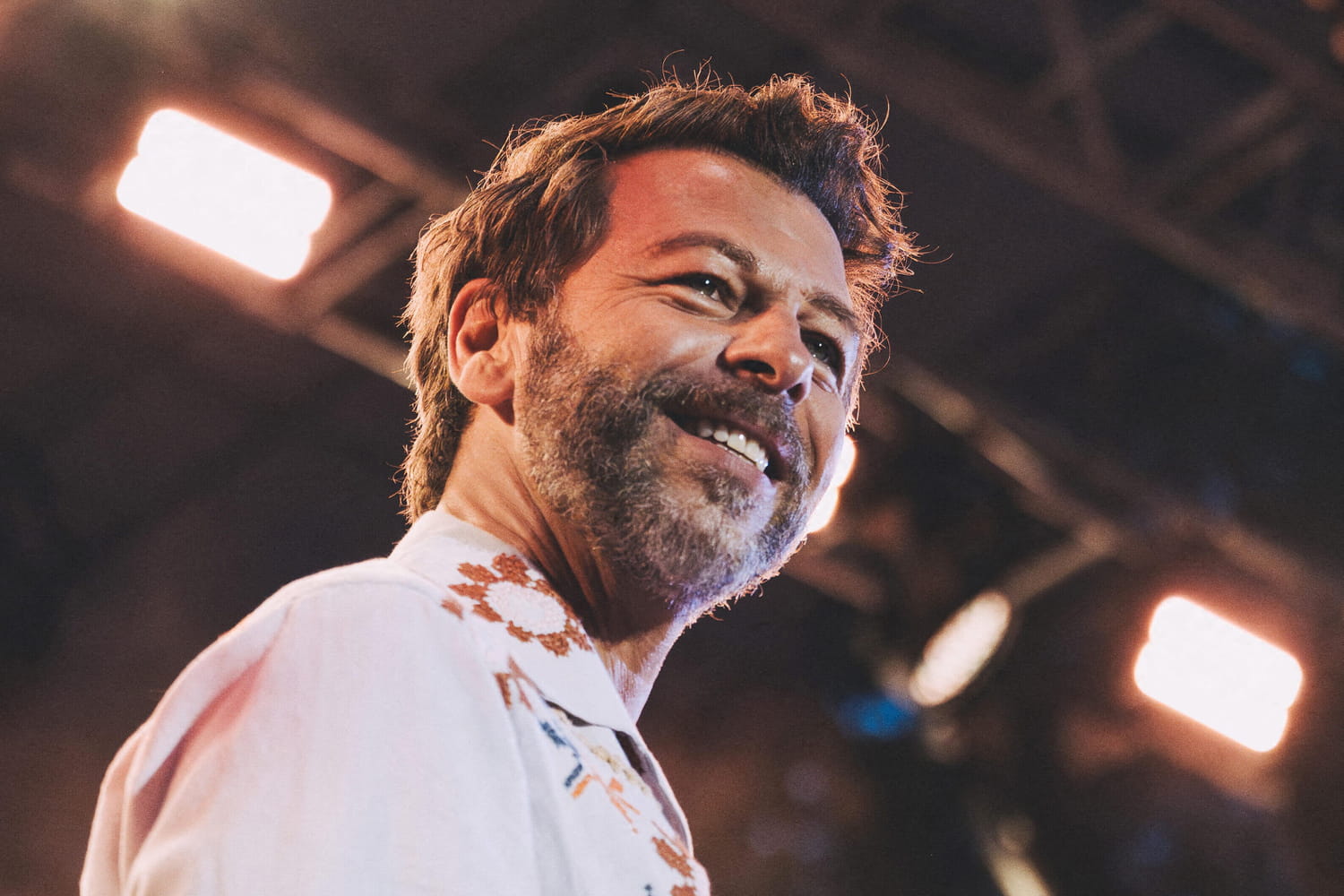

Social casino and casual games studio Murka has completed a management-led buyout, ending majority ownership by Blackstone and consolidating control under the company’s executive leadership. The transaction, led by CEO Barak Davidwas supported by MGG Investment Group LP. Financial terms were not disclosed.

While publicly framed as a move to accelerate growth, the buyout also marks a deeper structural shift: Murka has removed an ownership model that had become increasingly misaligned with the speed and autonomy required to compete in live-service gaming.

A Business That Outgrew Its Ownership Structure

Blackstone acquired Murka in 2019, backing the studio through a period of rapid expansion across social casino titles and supporting inorganic growth, including the 2021 acquisition of Mobile Deluxe. During that phase, Murka scaled into a significant regional publisher with millions of monthly users across mobile and web platforms.

But as the company matured, the operating environment changed. Social casino publishing has become more competitive, more data-driven, and more dependent on rapid iteration — from live-ops tuning and monetization adjustments to fast market testing and content deployment.

That evolution exposed a familiar tension: institutional ownership optimized for oversight and capital discipline versus a product business that now competes on speed.

Why Management Chose to Buy the Company Back

People familiar with the transaction describe the buyout as less about dissatisfaction with performance and more about execution drag. Strategic decisions increasingly required extended alignment across ownership layers, slowing responses to market signals and limiting leadership’s ability to act decisively.

In live-service gaming, where product changes are measured in weeks rather than quarters, that friction carries real cost. The management buyout resolves this by collapsing ownership and operational authority into a single decision-making body.

Leadership now controls strategy, risk tolerance, and execution timelines — and bears direct responsibility for the outcomes.

Governance Reset and Accountability Shift

Under the new structure, Murka operates without an external equity controller. This allows the company to:

-

Move faster on new market entry and regional expansion

-

Experiment beyond core social casino formats without prolonged approvals

-

Adjust live products and monetization mechanics in real time

Just as important, the buyout concentrates accountability. Decisions are no longer filtered through an ownership framework designed primarily to manage portfolio risk. Instead, incentives are directly tied to long-term product health, operational performance, and sustainable growth.

Capital Support Without Control Constraints

MGG Investment Group’s involvement provides financial backing without reinstating the governance bottlenecks the transaction was designed to remove. The firm specializes in structured capital solutions rather than control equity, enabling Murka to retain autonomy while supporting expansion and execution initiatives.

MGG’s broader institutional positioning following Generali Investments’ acquisition of a majority stake in its parent group further stabilizes Murka’s capital base without reintroducing ownership fragmentation.

A Structural Decision, Not a Strategic Pivot

The buyout does not represent a change in Murka’s core business. Social casino games remain legal in the company’s key markets, monetized through in-app purchases and advertising rather than cash payouts, and continue to generate consistent engagement across platforms.

Instead, the transaction reflects a governance recalibration — one increasingly common among mid-sized technology and gaming companies that reach a point where execution speed matters more than institutional oversight.

With ownership and management now aligned, Murka enters its next phase with fewer internal constraints and a clearer chain of authority — positioning the company to respond faster to market shifts without the structural drag that can emerge once businesses outgrow their original ownership models.