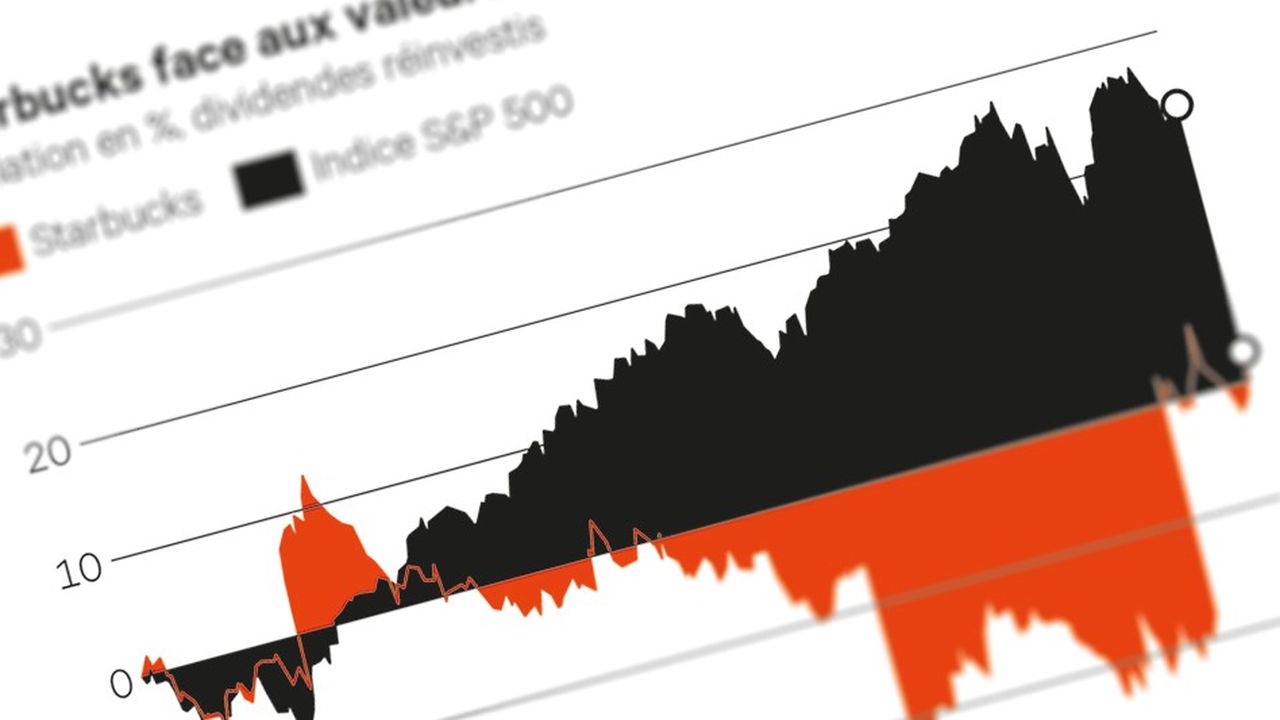

The pension reform has been criticized for being poorly prepared and poorly negotiated. So be it. However, repealing it would be very dangerous given the fragility of our public finances and the absolute need to redress them. Any sign of a worsening situation could trigger a serious financing crisis for French debt. Therefore, the repeal of this reform would be understood by savers and the markets as irresponsible. Public pension spending on GDP already represents 14.4% in France in 2022, compared to 11.9% in the eurozone.

But the repeal would also be very economically unfavorable to the French (for households or businesses) and, ultimately, would penalize employment and purchasing power. The only possible ways to ensure the balance of pay-as-you-go pension schemes are, firstly, to lower the level of pensions, which is obviously good neither for retirees nor for the economy.

Second, to increase social security contributions. For employees, this would cause a loss of purchasing power and downward pressure on demand. For companies, knowing that these social security contributions on GDP are already 50% higher in France than in Germany, this would reduce their competitiveness and lead to downward pressure on employment and wages.

Modulate

Third and final solution: modulate the length of working life according to demographic changes. Age measures (retirement age or, better, number of annuities), adjusted of course according to the arduousness of each person’s work, are the only ones capable of reconciling the interests of current or future retirees with the search for the best growth potential for the economy, employment and purchasing power. All the more so since even today, many companies cannot reach their full growth potential due to a lack of labor, whether qualified or not.

Reminder: in France, we had 4 contributors for 1 retiree in 1960. In 2010, there were only 1.8 contributors for 1 retiree and it will be 1.2 in 2050. At the same time, in 1958, life expectancy at retirement age was 15.6 years for women and 12.5 years for men. In 2020, these figures reached 26.9 years and 22.4 years respectively… However, the retirement age is lower today than in 1958!

Healthy life expectancy after retirement has also increased considerably. In France, only about 30% of people aged 60 to 64 work, while in other eurozone countries, the figure is almost 50% (57% in Germany, 68% in Sweden).

Integrate

All neighbouring countries have indeed raised the retirement age, for the same reasons and out of realism, from 65 to 67 years. The reality principle must also, finally, take hold of us, so that our pay-as-you-go pension system is not endangered by the inability to finance it. The reform under discussion, even if insufficient, is a step in the right direction. It is always possible to amend it somewhat, but be careful not to open Pandora’s box…

Finally, two thoughts. First of all, work is not only economically necessary, it is also most often a means of integration, socialization and self-realization. Let us therefore facilitate the work of those over 60 and encourage companies to keep them, or even hire them. The second: work is not to be shared because it would be in finite quantity. It is a static and erroneous view of the economy that leads to thinking this way. Work creates work in a dynamic where supply and demand feed each other. All empirical work confirms this.

Olivier Klein is a professor of economics at HEC.