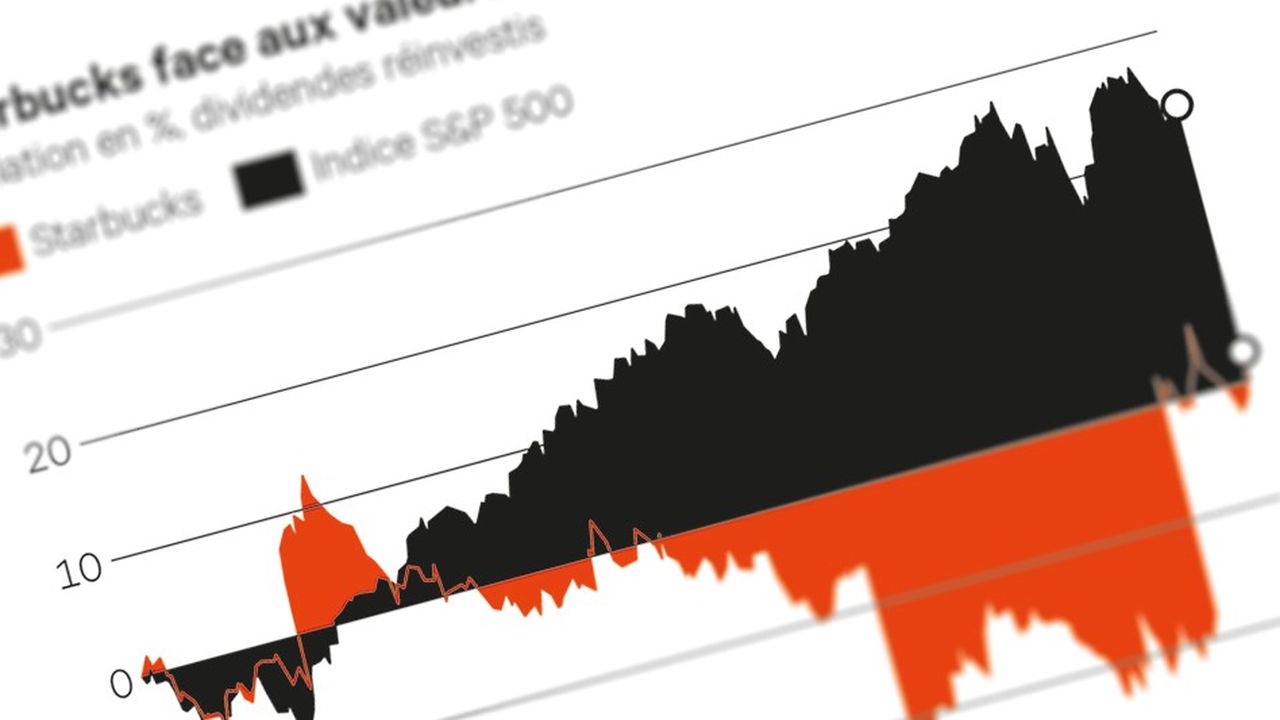

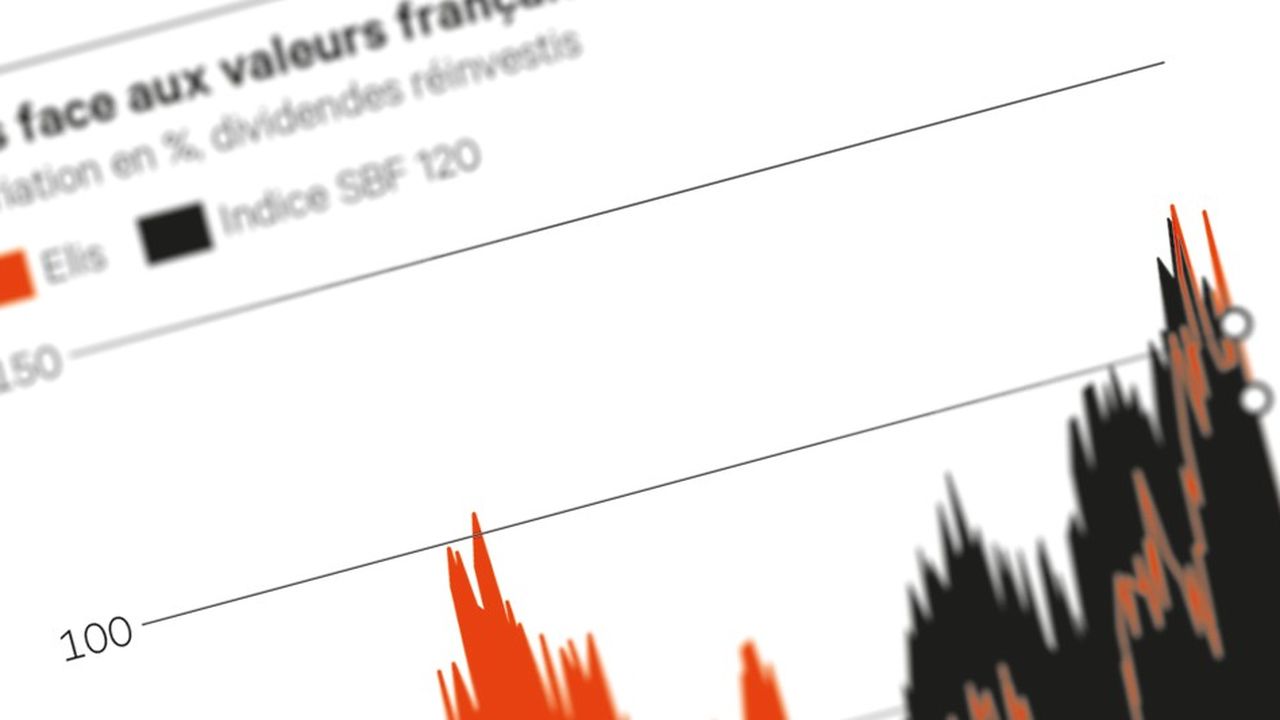

Clothes make the man, but they do not make the man. Elis’ consideration of the acquisition of Vestis, the American number two in professional uniforms, therefore resulted in a penance for its action (-15.7%), before a press release promising to maintain financial discipline.

An entry into the United States would seriously strengthen the international development strategy of the flagship of industrial laundry. It could also suffer on two counts, as Bernstein experts point out, the lack of synergies and the rise in debt.

The stock market, which was expecting smaller purchases, is therefore fearing the temptation of a capital increase to finance an indebted target, weighing a good third of its market capitalization.

Berendsen’s precedent

If the boss Xavier Martiré has integrated the British Berendsen _a bigger catch_ the price had not returned to its level of early 2018 until 2024, not helped much by Covid-19 it is true.

Much more powerful French blue chips have been punished because of this spectre of dilution by acquisition, such as Air Liquide when it announced Airgas in 2015 (-6.7%) or Axa with XL in 2018 (-9.7%).

And Vestis confessed to disappointing growth last May, and caused a fifth of its value to be burned at the stake in one session. A buyer could try to take advantage of that. But American sellers are known for not being choirboys.

Please note

While confirming a preliminary approach to Vestis, Elis promises to respect its commitments of financial discipline. The company wants to maintain its financial rating “investment grade”. Its financial debt leverage would not exceed 2.2 times the ebitda in the first year of the acquisition, and 2 times the following year, with a positive effect on earnings per share from the first year.

Elis had previously targeted a leverage of 1.8 at the end of 2024, compared to 2 at the end of 2023. Its net financial debt amounted to 3.2 billion euros at the end of last June. Its capitalization amounts to 4.5 billion, before the press release issued after the stock market close. Vestis’ net debt was 1.5 billion dollars at the end of June, with a leverage close to 4.

The acquisition of Berendsen in 2017 was financed partly with shares.