Monzo’s Power Shift: Diana Layfield to Replace TS Anil as CEO Ahead of 2026 IPO

Fintech leader Monzo has announced that Diana Layfield, a former Google executive, will succeed TS Anil as CEO in 2026. The transition comes as the UK digital bank gears up for its highly anticipated IPO. Layfield’s appointment signals a new growth era for Monzo, with investors eyeing its global expansion and profitability strategy.

Monzo’s Big Move: Leadership Change Before the IPO

In a headline-grabbing decision, Monzo Bank revealed that former Google executive Diana Layfield will step into the role of CEO in 2026, succeeding long-time leader TS Anil. The move comes as Monzo prepares for its long-awaited initial public offering, a milestone that could redefine the UK fintech landscape.

The announcement electrified both the tech and finance sectors, with analysts calling it a strategic masterstroke. According to analysis reviewed by CEO Today, Monzo’s leadership shuffle positions it to capture global attention as it moves from disruptive challenger to established financial heavyweight.

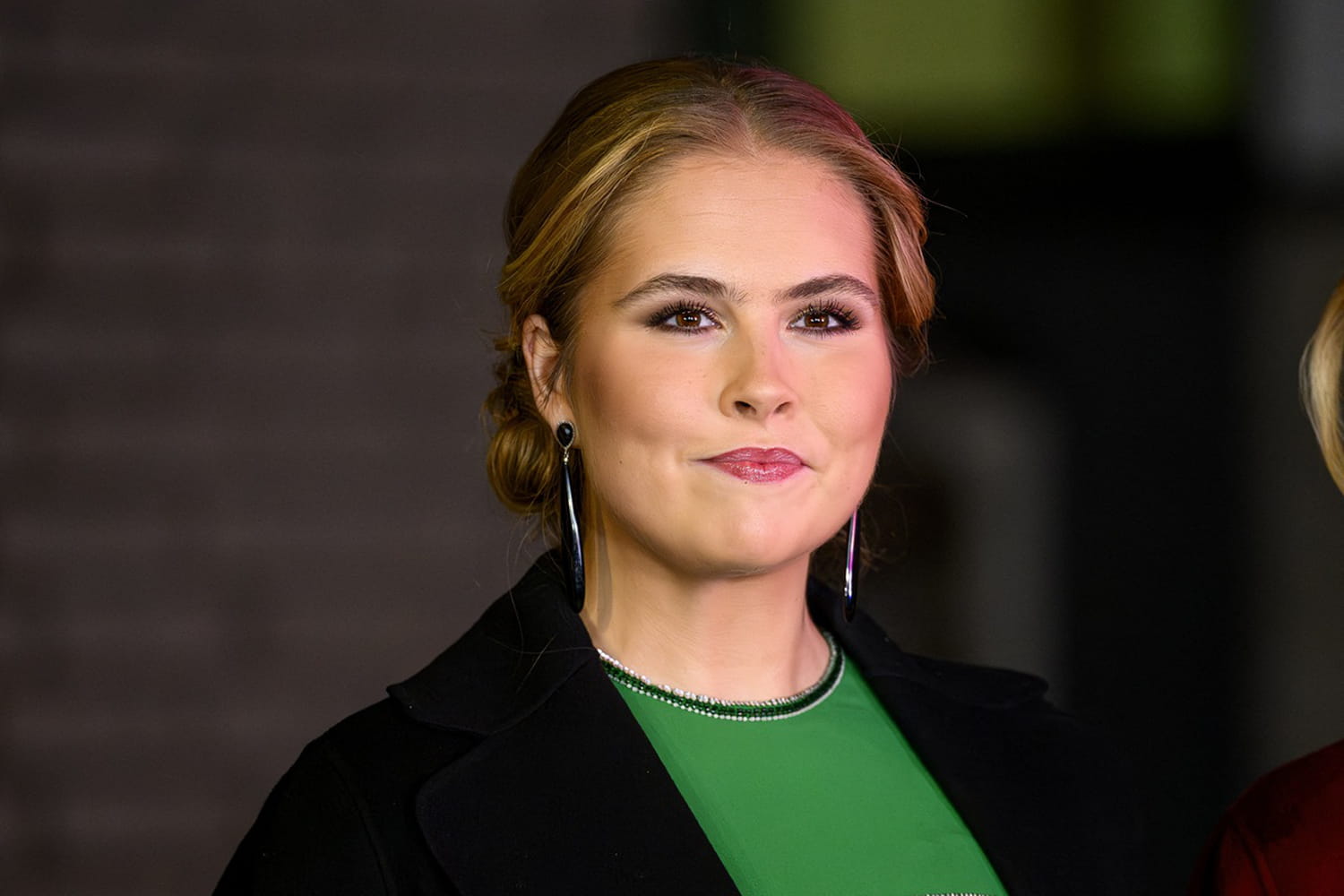

Diana Layfield

Who Is Diana Layfield? From Google to Global Banking

Diana Layfield isn’t new to transforming industries. Before joining Monzo, she served as President of EMEA Partnerships at Google, where she led initiatives on digital innovation, sustainability and AI partnerships. Earlier in her career, she was CEO for Africa at Standard Chartered Bank, giving her deep insight into financial systems across emerging markets.

Her mix of Silicon Valley and traditional banking experience could be exactly what Monzo needs as it scales internationally. “Layfield’s appointment shows Monzo’s intent to mature without losing its tech DNA,” said fintech analyst Sarah Kocianski, adding that “The next 18 months will determine whether Monzo can translate its cult following into long-term profitability.”

TS Anil’s Legacy: Building a Bank People Actually Love

Outgoing CEO TS Anil, who took over in 2020, helped transform Monzo from a niche digital startup into a mainstream banking force with over 9 million customers. Under his leadership, Monzo expanded into lending, savings and business accounts while maintaining its signature transparency and app-first model.

In a statement, Anil expressed his pride in Monzo’s evolution, saying: “We built something rare — a bank that customers genuinely love and trust. I’m thrilled to hand it over to someone who can take it even further.”

The Road to IPO: What’s Next for Monzo

Monzo’s leadership transition arrives as the fintech sector braces for a wave of IPOs in 2026. Investors expect the company to be valued between $5 billion and $7 billion, depending on market conditions and user growth. Analysts predict that Layfield will focus on AI-driven services, global partnerships and new product innovation, capitalizing on her Google background.

The broader UK fintech market has become increasingly competitive, with rivals like Revolut and Starling Bank pursuing their own IPO ambitions. Layfield’s challenge will be steering Monzo through regulatory hurdles while preserving the authenticity that made it a consumer favorite.

A New Chapter for UK Fintech

Monzo’s CEO succession marks more than a simple leadership change — it represents the maturing of an entire industry. As one of Britain’s most recognizable fintech brands, Monzo’s next steps will shape how digital banking competes globally.

Financial expert Susannah Streeter from Hargreaves Lansdown commented, “Monzo’s move underlines how serious fintech has become. Appointing a CEO of Layfield’s caliber suggests Monzo is no longer just a challenger — it’s aiming to play in the major league.”

With Monzo’s IPO on the horizon and a leadership team blending banking acumen with tech innovation, 2026 could be the year it cements its place among the world’s most valuable digital banks.

FAQ — Monzo’s Next Chapter Explained

1. When will Diana Layfield become Monzo’s CEO?

She is set to officially take over from TS Anil in early 2026, aligning with Monzo’s IPO timeline.

2. What is Monzo’s current valuation?

Recent estimates place Monzo’s valuation between $5 billion and $7 billion, although the IPO could push this higher.

3. How does Monzo plan to expand globally?

Monzo aims to leverage Layfield’s global experience to expand into new markets, especially across Europe and North America, while developing new AI-driven banking tools.