In the “Great Savings Rendez-vous” (Capital / Radio Patrimoine), Nathalie Couzigou-Suhas, notary in Paris, sheds light on the consequences of a donation between spouses in the event of divorce … or succession.

Capital video: Is a donation between spouses questioned in the event of divorce?

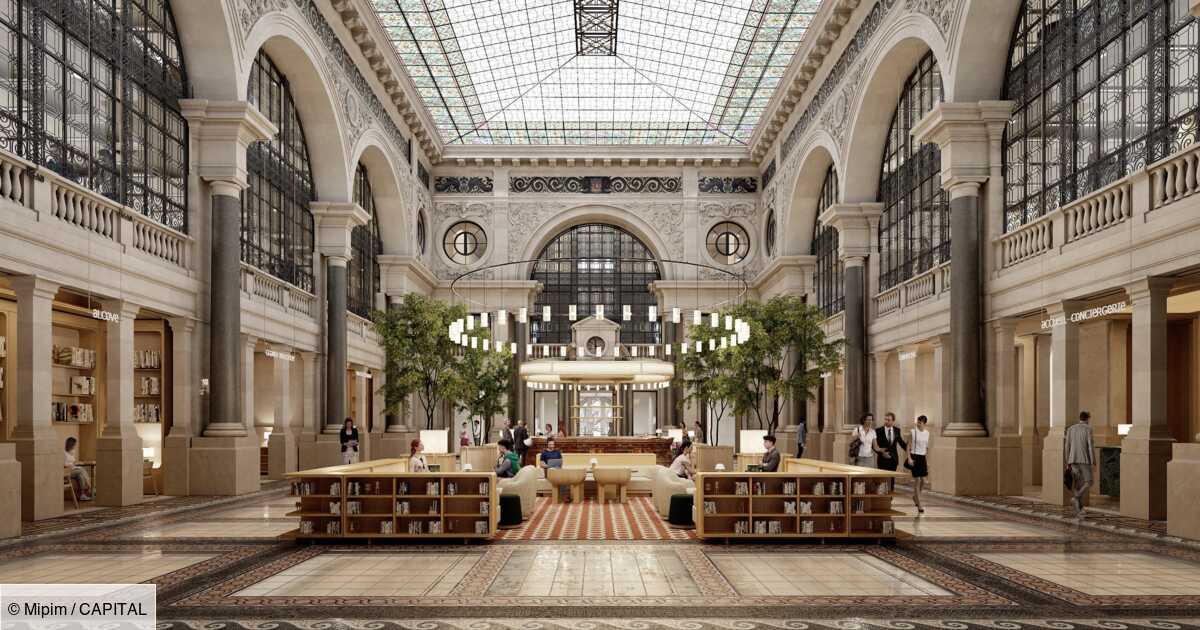

© Capital

– Does the donation between spouses have a risk?

-

To safeguard

Saved

Receive alerts The big savings meeting

Each month, the “big savings meeting” (capital / radio heritage) answers your questions in the “your questions, our answers” sequence. Our experts – notaries, taxpiens, heritage advisers – accompany you on all your money questions. Today, Magali wonders about a donation envisaged by her husband to rebalance their heritage and start to initiate transmission to their children: could this donation be called into question in the event of divorce?

If the intention may seem laudable, it raises important tax questions, notes Nathalie Couzigou-Suhas, notary in Paris: “Magali’s husband wants to rebalance their real estate assets via a donation of 225,000 euros. But this operation could be reclassified as abuse of law if it is not well supervised.»» The taxman could indeed see a disguised tax optimization attempt, especially if this donation is used to distribute the heritage before a succession to children.

A donation can no longer be canceled in the event of divorce

What would happen in the event of a divorce? Contrary to popular belief, the donations of goods present between spouses are irrevocable. “Since the law of May 26, 2004, a donation between spouses can no longer be canceled in the event of divorce”recalls the notary. However, if the succession between spouses is exempt from transfer rights, this is not the case with a donation made during the living. “A reduction of 80,724 euros applies, but beyond, the rights are 20%”specifies Nathalie Couzigou-Suhas.

Rather than going through a classic donation, another solution exists to avoid transfer duties: “It is more judicious to modify their matrimonial regime. For example, by bringing property to a community or a company of acquests, with non-reprise clause in the event of divorce ”suggest our expert. Since the law of March 23, 2019, it is easier to develop your matrimonial regime, even if adult children must be informed. “We arrive at the same result as with a donation, but without paying rights and without taking the risk of a tax recovery”Concludes Nathalie Couzigou-Suhas. Provided of course to be able to justify this operation with the administration.

Life insurance, PEL: which product to choose to prepare your retirement and then transmit with little income?

Ask our experts to our experts

A question about your investments, a succession, your taxes or your real estate investments? Each month, we select several and submit them to our experts who will enlighten you on all the subjects that affect your money. To ask them your questions, an address: [email protected]

Receive our latest news

Each week, the flagship items to accompany your personal finances.