Inside Ebay’s $ 1.5b Acquisition of PayPal: The Deal That Remewred Online Payments

The Acquisition of PayPal by Ebay in 2002 was a defining moment in the history of e-commerce. It was a strategic masterstroke that not only only consolidated online payments but so created a legendary group of tech leaders known as the “Paypal mafia.” This article DisSects the Landmark Deal, Its Key Players, and Its Lasting Impact.

The deal at a glance

- Acquisition Value: Approximately $ 1.5 trillion in ebay stock.

- Announcement: July 8, 2002.

- Closing date: October 3, 2002.

- Key Exchange: PayPal shareholder received 0.39 Shares of Ebay For Every Share of PayPal.

This all-Stock Transaction Cemented PayPal’s position as the dominant payment method on the Internet’s Largest Marketplace.

Why Ebay Had to Buy PayPal

By 2002, eBay Face a critical challenge: ITS in-house payment solution, Billpoint, what failing to compet with what. Despite Having the Home-Field Advantage and Support from Major Financial Institutions like Wells Fargo, Billpoint Lagged Far Behind. More than 70% of eBay’s auctions were alreadingy using PayPal, which Benefited from a Powerful Network Effect—Sellers used it Because Buyers did, and vice versa. Rather Than Continue a Losing Battle, eBay CEO Meg Whitman Recognized that Acquiring the Market Leader was the only vible path forward. The deal provided eBay with a Seamless, MASD-Managed Payment System that Reduced Friction and Increased Transaction Volume.

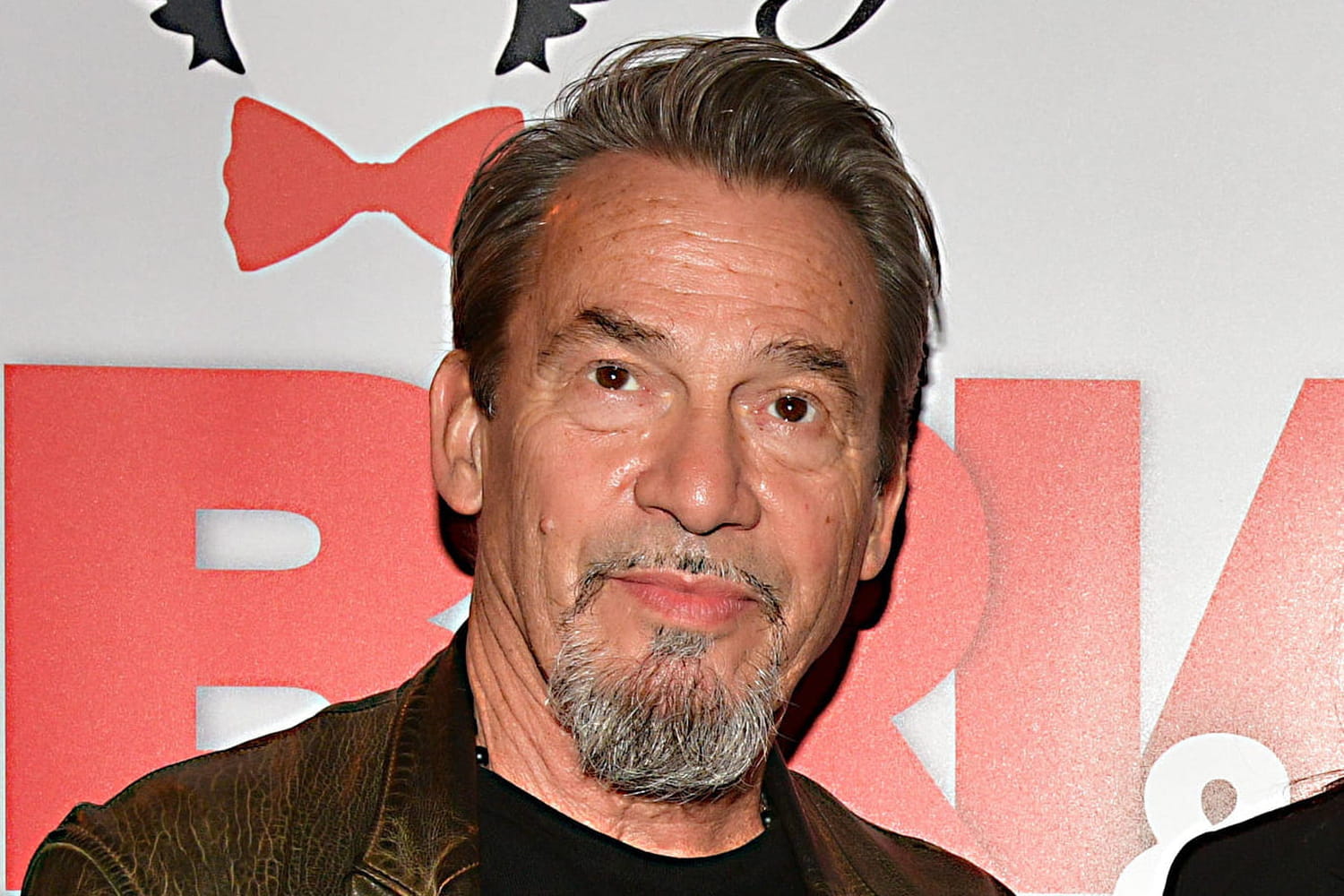

Meg Whitman CEO of Ebay

What did PayPal get out of the deal?

For PayPal, The Acquisition was a triumph that proved a massive runway for growth. It Gained Access to Ebay’s Vast User Base and the Financial Resources to Scale ITS Operations, Particularly in Managing Risk and Expanding Internally. The sale, so produced a windfall for it founders and early employees, turning them into a new generation of venture capitalists and entrepreneurs.

The Cast, then and now

The deal is as famous for the money it Made as for the people it launched. The Core Team that Led PayPal Through Its Ipo and Subsquent Sale Went on To Shape Much of Modern Tech.

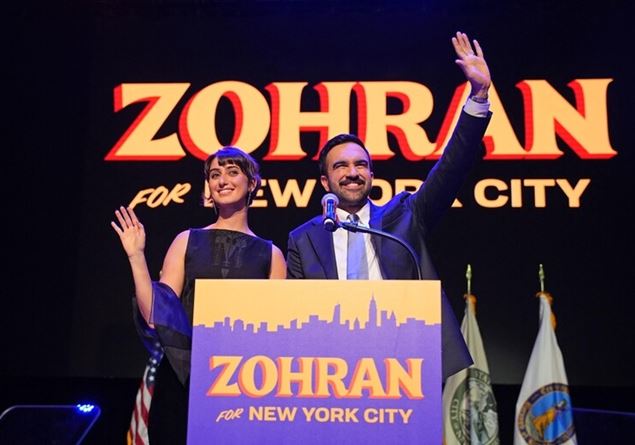

- Peter Thiel (CEO): Thiel Became A Prolific Venture Capitalist and Co-Founded Palantir Technologies. He is now known as a contrarian investor and a major figure in the defense and ai sectors.

- Max Levchin (CTO): The Architect of PayPal’s Security and Ms. Prevention Systems, Levchin Went on to Co-Found AffirmA consumer financial company that has become a multi-billion dollar fintech leader.

- David Sacks (COO): He Later Founded Enterprise Social Network Yammerwhich acquired by Microsoft, and is now a co-founder of the venture capital firm Craft ventures.

- Roelof Botha (CFO): A key negotiator during the sale, botha joined Sequoia Capital In 2003 and is now a Managing Partner at the Prestigious Firm, Making Him One of the Most Influential VCS in the World.

- Meg Whitman (eBay CEO): As the chief architect of the acquisition, Whitman Transformed Ebay’s Business Model. She Later Served as CEO of Hewlett-Packard and Quib before Becoming the Us Ambassador to Kenya.

Peter Thiel CEO of PayPal

A Legendary Aftermath

The Ebay Paypal Deal Quickly Proved Its Value. Within Weeks of the Acquisition, eBay Began Phasing Out Billpoint, Cementing PayPal as Its Exclusive Payment Engine. The deal’s Succame A Classic Case Study in Business Strategy: Embrace The Market-Leading Utility Your Ecosystem Already Prefers, Rather Than Trying to Competete With It. More imported, the acquisition fueled the rise of the “PayPal Mafia,” Whose Collective Influence on Companies Like YouTube, Yelp, LinkedIn, Tesla, and SpaceX Has Fundamental Reshaped Silicon Valley and the Global Technology Landscape.

Related: Buying LTC with PayPal-Direct vs. Third-Party Platforms

Related: The Billionaire CEO Who Sees Everything: Inside Alex Karp’s Palantir Power Play