Mario Draghi’s alarm call on Europe’s competitiveness lag risks running into the “nein” of “frugal” countries. His inventory and his 170 proposals do not deserve to be swept aside, including the old sea serpent of financing the economy.

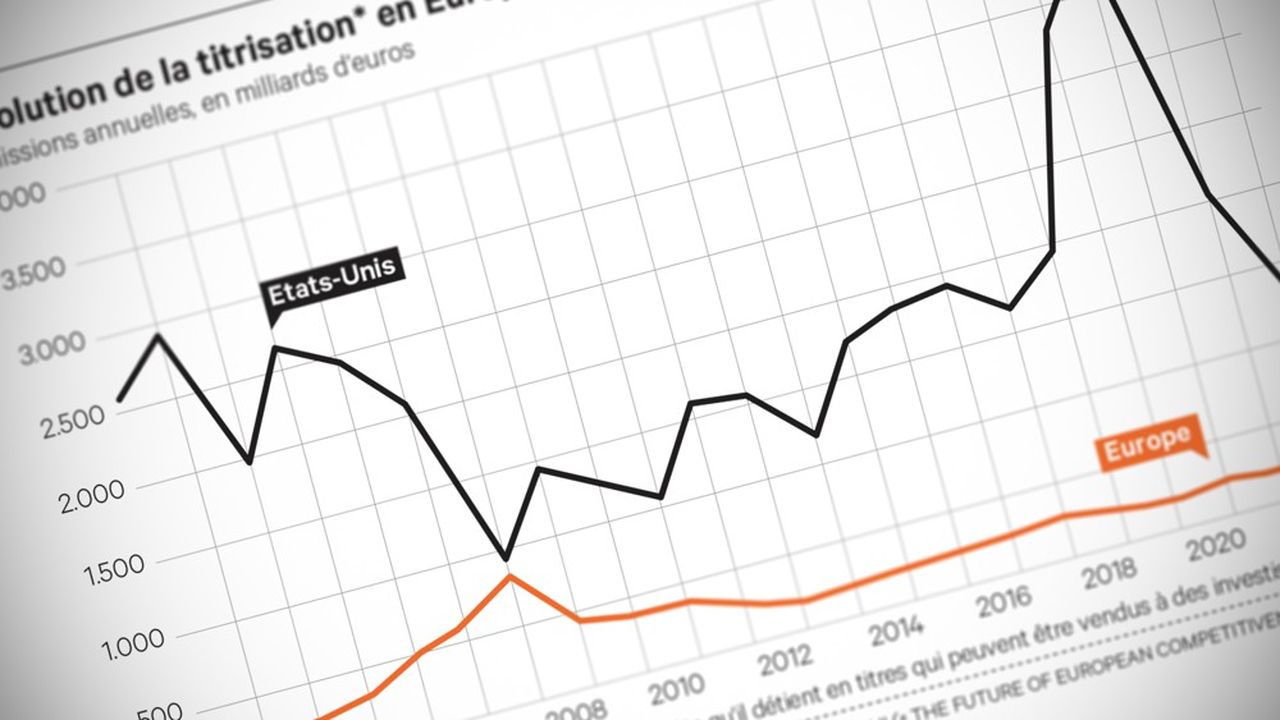

Because the latter depends more on banks than in the United States and Japan. The development of loan securitization would have the double advantage of lightening their balance sheets and growing a common financing market.

A graph since 2002 shows the difference in scale with Uncle Sam, linked to the prominent role of federal guarantee agencies. But for this financial technique, too deregulated before the 2007 crisis, to really make the strength of the Capital Markets Union, the report recommends maintaining vigilant market supervision and prudent banking regulation.

Discover the Premium Business offer!

Back to school, give your teams a head start with the right information at the right time for informed decisions. Exclusive analyses, sector monitoring tools, VIP invitations to networking events… Discover all the Premium Business benefits!

I discover the offers