To build up a comfortable retirement often seems complicated. However, there is a simple and concrete tip that everyone should know.

Preparing for retirement tends to stress many French people. With the complexity of pension plans, regular reforms and uncertainty about the amount of his future pension, many seek concrete solutions to complete their retirement income. Often, this preparation may seem difficult to set up, especially for those who are not interested in their lives early. However, adopting certain simple reflexes from the age of 30 can really make a difference, as many experts confirm.

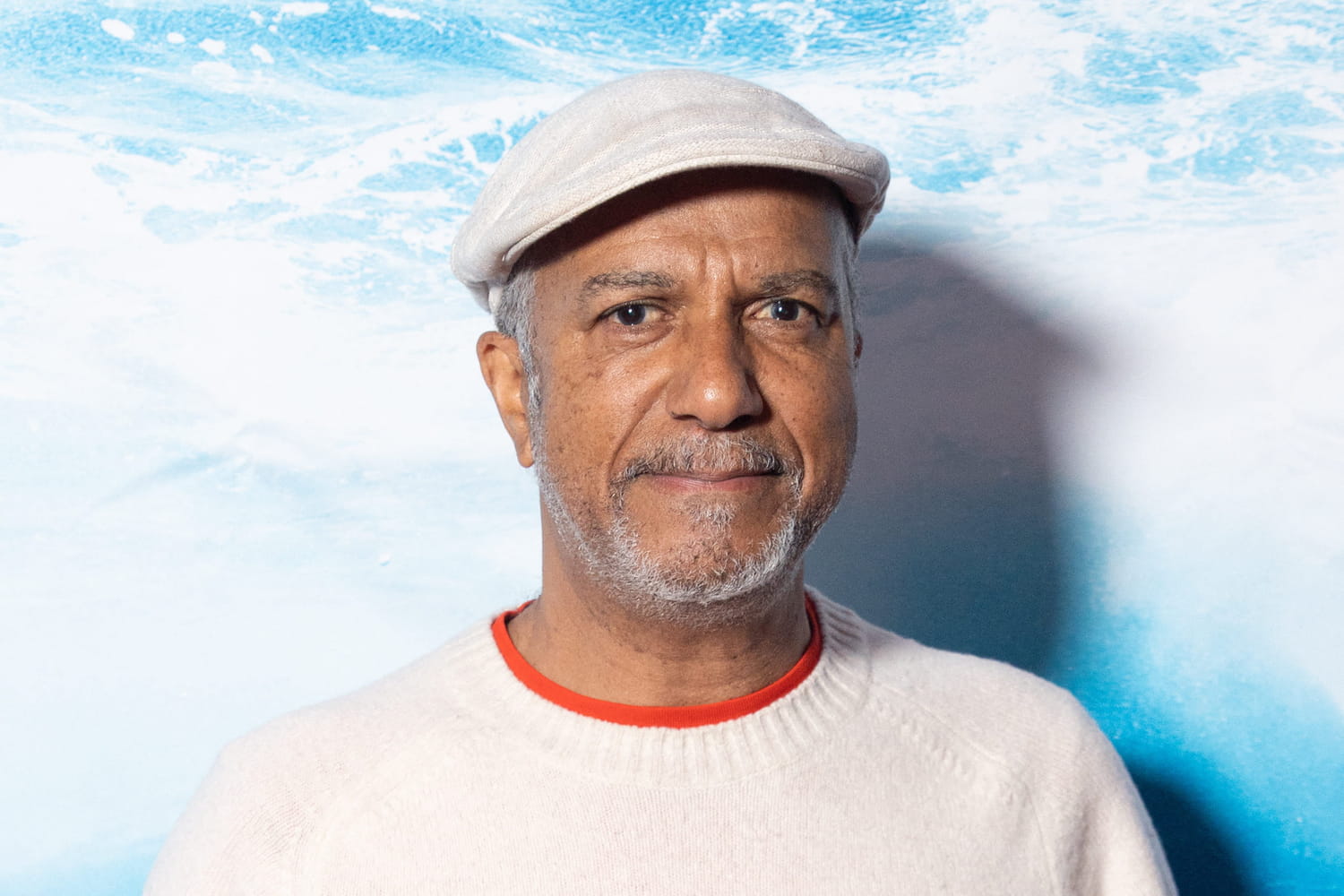

Passing through the program Legend, Matthias Baccino, former trader today Europe director of Trade Republic, offers clear and accessible advice: “5% of what you earn from your 30 years up to your 64 years, you invested it”. He insists on the importance of saving regularly, placing around 5% of his income each year. But that’s not all: so that this fruiting savings, it is necessary to target a performance of around 5% per year. “”5% performance every year on its savings, when you have a booklet that is 3%, it’s not easy“, He admits.

His solution? Investing in shares, which in the long term have shown an average growth of around 5.5% per year, despite crises and wars. To minimize the risks, he advises to choose the most diverse possible investments, such as ETF: these “baskets of action” which bring together tens, even hundreds of companies around the world.

But what exactly? To put it simply, an ETF (for Exchange Traded Fund) is like a basket in which we put lots of different actions. By buying an ETF, we therefore invest in several companies at the same time, which reduces risks because if a company encounters difficulties, the others can compensate. This avoids betting everything on a single action. In addition, the costs related to ETFs are often lower than those of investments managed by professionals, making it a practical and accessible tool. For those who start, it is advisable to start gradually, putting aside a small sum regularly, without trying to make a fortune quickly, but by building savings that will grow slowly, but surely.

Matthias Baccino also recalls that the key to long -term success is regularity and patience – you have to keep your investment even during difficult periods, because over several decades, the historical trend of markets remains positive. It is not necessarily complicated, and you can be accompanied by its banker or his management advisor, if necessary, to put all the odds on his side!