Maduro’s Crypto Strategy Triggers a Regulatory Stress Test for Global Finance

Sanctions Pressure Pushes Venezuela Into Crypto Settlement

Power is shifting away from governments that design sanctions and toward the financial infrastructure that can bypass them. Venezuela’s use of crypto-linked oil settlements has exposed a structural weakness in global enforcement, transferring influence from public institutions to private technology providers. The reputational and regulatory exposure now sits with companies that never sought political relevance but cannot escape it.

President Nicolás Maduro is not attempting financial reinvention. He is responding to constraint. Years of US and European sanctions reduced access to dollar clearing, correspondent banking, and conventional commodity settlement. That pressure forced Venezuelan entities to seek alternative rails. Crypto emerged not as an ideological choice, but as an operational one.

This decision changed the balance of responsibility. Oil exports remain Venezuela’s primary source of state revenue, but the settlement layer has changed. Where banks once bore compliance risk, stablecoin issuers and crypto platforms now face scrutiny. Regulators are questioning whether private infrastructure can shoulder obligations traditionally enforced through licensed financial institutions.

Maduro retains domestic control. Internationally, his leverage is limited. Each workaround increases reliance on intermediaries operating outside clear jurisdictional boundaries. That dependence creates new enforcement chokepoints. The strategy preserves cash flow in the short term while expanding exposure over time.

For global markets, the issue is no longer Venezuela alone. It is whether sanctions retain credibility when settlement technology evolves faster than enforcement frameworks.

Why Sanctions Enforcement Is Colliding With Crypto Infrastructure

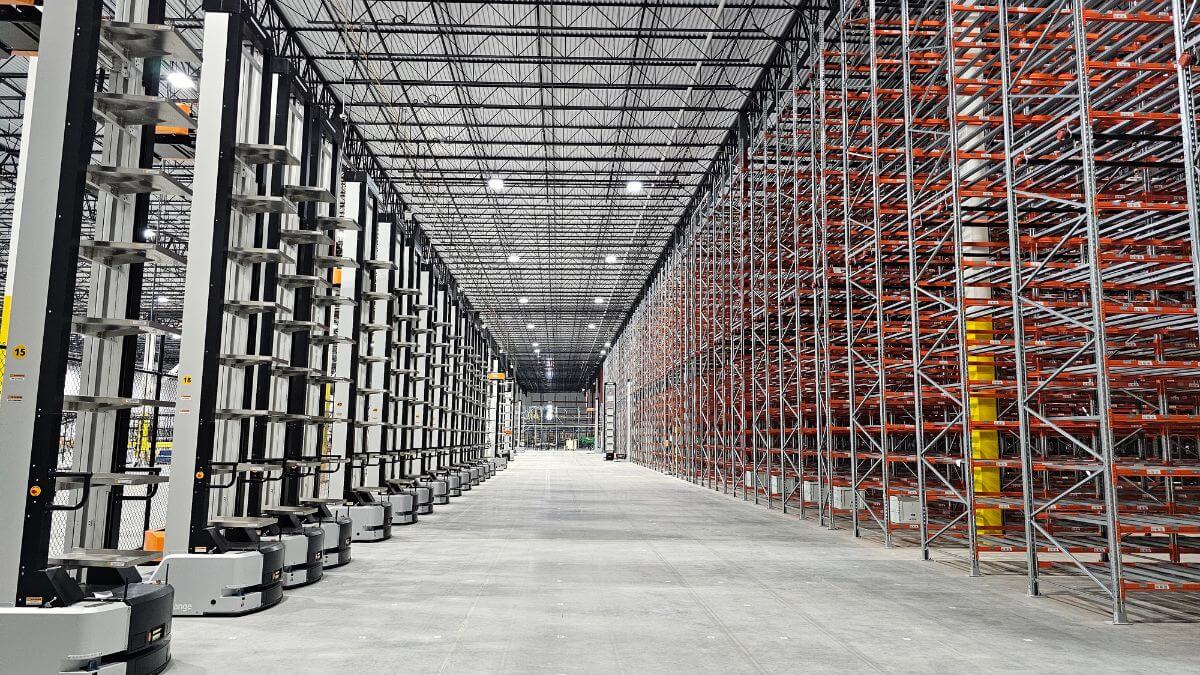

Sanctions regimes were built for a banking system defined by identifiable intermediaries and centralized control. Crypto infrastructure operates under different assumptions. Transactions are peer-to-peer. Issuers do not approve individual transfers. Jurisdiction is fragmented by design.

That mismatch has created institutional friction. Regulators expect compliance controls comparable to banks. Crypto firms argue their tools are neutral. The Maduro case has tested that claim. Infrastructure neutrality no longer shields firms from responsibility when sovereign actors exploit gaps.

Enforcement agencies now examine blockchain data rather than bank records. Public ledgers provide transparency, but attribution remains complex. Acting on that data requires speed and coordination regulators are still developing. This lag has shifted pressure onto executives expected to anticipate misuse rather than respond to it.

Boards face a compressed decision environment. Restrict access aggressively and risk alienating legitimate users in fragile economies. Move slowly and risk enforcement action that could restrict operations entirely. The pace of geopolitical change is stripping traditional governance cycles.

| Old leadership logic | 2026 Decision Reality |

|---|---|

| Platforms are neutral tools | Infrastructure carries enforcement responsibility |

| Compliance is reactive | Compliance must be anticipatory |

| Sanctions target states | Sanctions increasingly target settlement rails |

| Risk sits with users | Risk migrates to issuers and boards |

This tension is structural. No single leader can resolve it without trade-offs that reshape their business model.

The Executive Dilemma Inside Global Stablecoin Firms

Crypto executives are discovering that scale brings strategic isolation. As platforms grow, they attract sovereign interest and regulatory attention simultaneously. Success narrows room for maneuver. Every decision carries geopolitical consequences.

Stablecoin issuers did not design products for oil settlement. Their tokens were adapted to fill a vacuum created by sanctions. That adaptation placed them at the center of a dispute between enforcement objectives and market demand.

Leadership now operates under conflicting expectations. Governments demand cooperation and visibility. Users expect uninterrupted access. Investors expect growth and stability. Meeting one expectation often erodes another.

The Maduro case illustrates how quickly infrastructure can become politicized. Once associated with sanctions evasion, a platform’s reputation shifts. That perception influences partnerships, banking access, and regulatory posture across jurisdictions.

Executives are not choosing sides. They are absorbing consequences. Governance capacity, not intent, has become the metric regulators use to assess responsibility.

Maduro

How Regulators, Investors, and Energy Markets Are Responding

The ripple effects extend far beyond Caracas. Enforcement bodies in the United States and Europe are coordinating scrutiny of crypto-linked settlement activity tied to energy exports. Their actions influence confidence across digital asset markets.

Institutional investors are reassessing exposure. Asset managers evaluate not only direct holdings in crypto firms but also the settlement rails embedded within portfolio companies. Risk committees are revising assumptions about compliance durability and regulatory shock.

Market infrastructure providers face parallel pressure. Data firms, exchanges, and analytics platforms are expected to support enforcement with actionable intelligence. Failure to do so risks exclusion from regulated markets or loss of institutional clients.

Energy traders are recalibrating counterparty risk. Settlement method now influences pricing. Cargoes settled through opaque rails command discounts. That valuation adjustment feeds back into state revenue calculations, reducing the economic benefit of workaround strategies.

Policy bodies such as the OECD view the situation as a precedent. If sanctions can be bypassed without consequence, their deterrent value erodes. If enforcement overreaches, humanitarian harm increases. Regulators are navigating a narrow corridor between credibility and proportionality.

Central banks observe closely. Stablecoins functioning as settlement assets blur the line between payment instruments and shadow currencies. That reality informs future regulatory design.

Market Repricing Begins as Crypto Becomes a Sanctions Risk

Every decision taken by Venezuelan authorities has triggered second-order exposure across markets. Stablecoin issuers face reputational risk that affects partnerships and valuations. Banks reassess relationships with crypto firms linked to geopolitical exposure. Insurers adjust coverage terms and exclusions.

Valuation shifts are already visible. Companies perceived as enforcement risks trade at a discount. Firms demonstrating proactive governance attract capital. Compliance capacity has become a differentiator rather than a cost center.

This repricing is uneven. Firms operating in jurisdictions with clear regulatory frameworks benefit from relative certainty. Global platforms face fragmented obligations and higher compliance costs. The result is consolidation pressure as smaller players struggle to fund governance infrastructure.

Maduro’s strategy accelerates this process. Each headline reinforces the association between crypto and sanctions risk. That narrative influences policymaking and investor behavior, regardless of nuance.

Capital Withdraws Where Governance Cannot Keep Pace

Capital follows predictability. Venezuela offers little. Crypto reduced transaction friction but increased opacity. Investors price that uncertainty aggressively.

Funds exposed to emerging markets now incorporate digital settlement risk into sovereign assessments. Infrastructure choices influence financing costs. States relying on unconventional rails face higher risk premiums and reduced access to capital.

This dynamic extends beyond Venezuela. Any government considering crypto-based settlement must weigh short-term access against long-term isolation. Markets respond quickly to governance signals. Liquidity recedes where confidence erodes.

For crypto firms, the implication is direct. Participation in sovereign workarounds may deliver volume, but it undermines trust. Trust anchors valuation. Boards must decide which revenue streams justify long-term exposure.

What Boards Must Do as Enforcement Expectations Escalate

Boards overseeing crypto infrastructure should act decisively. First, commission independent audits of exposure to sanctioned jurisdictions. Transparency buys time and credibility. Silence invites scrutiny.

Second, engage directly with regulators. Waiting for formal inquiries cedes narrative control. Proactive disclosure positions the firm as a participant in enforcement, not an obstacle.

Third, reassess governance capacity. Monitoring, reporting, and escalation mechanisms must scale with usage. Enforcement expectations will rise, not implied.

Fourth, communicate clearly with investors. Explain trade-offs and strategic intent. Markets punish uncertainty more than constraint.

Finally, scenario plan for access restrictions. Liquidity planning should reflect enforcement risk. Leadership under constraint is not about moral positioning. It’s about institutional survival.

Where Final Authority Now Sits

The outcome will not be decided in Caracas. It will be shaped by regulators in Washington and Europe, by enforcement agencies interpreting old laws in new contexts, and by investors reallocating capital accordingly.

The US Treasury and its enforcement arms hold decisive influence. Their interpretation of responsibility will define the boundary between infrastructure and liability. Stablecoin issuers and their boards are now operating inside that boundary.

This is no longer a story about crypto experimentation. It is a test of how global finance adapts when private infrastructure carries public consequence.