When the Master Investor Becomes the Principal Owner: Michael Burry’s Shift from Fee Business to Capital Control

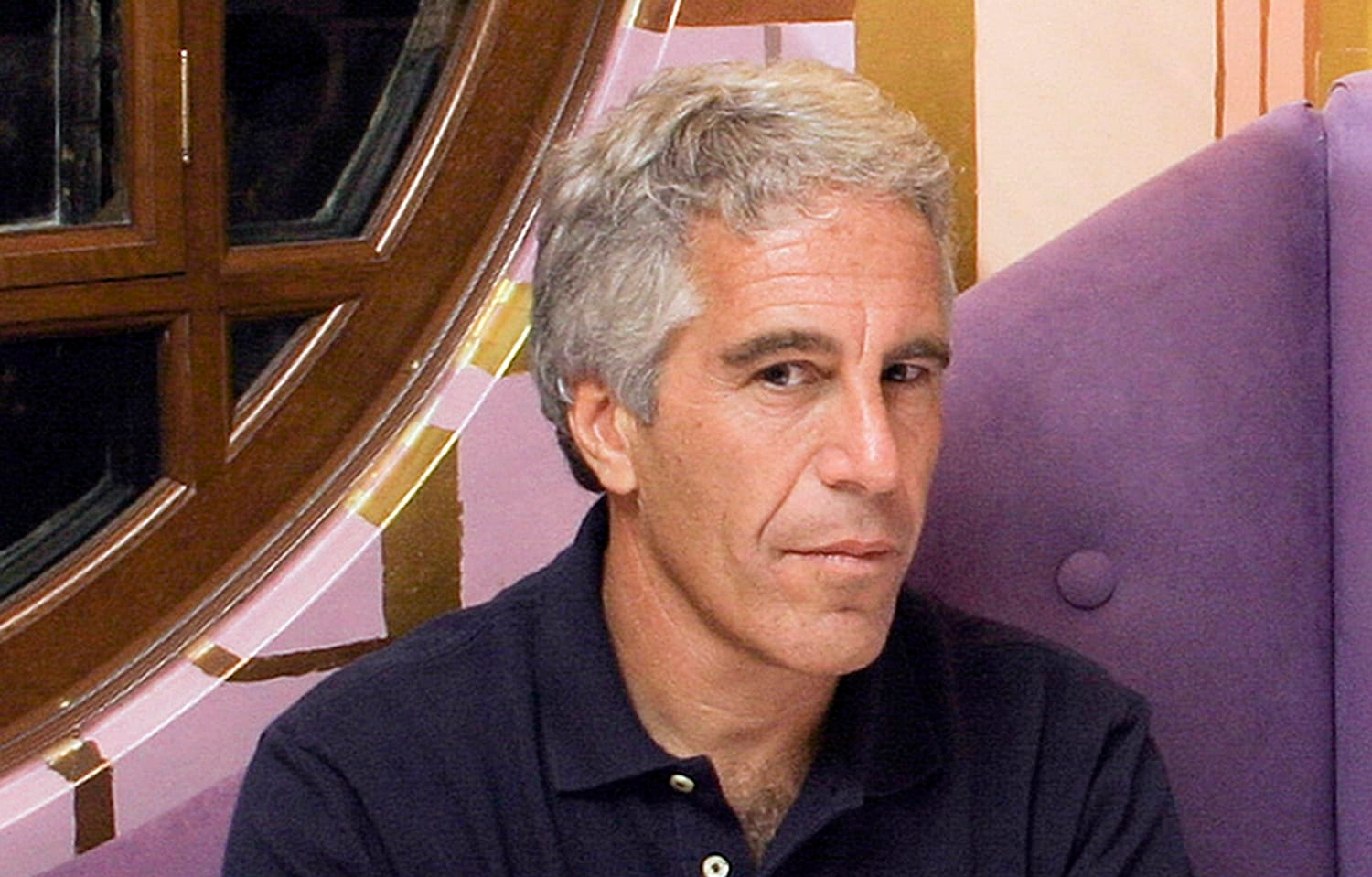

There’s a particular moment in the life cycle of great investors when they stop playing the game for others and begin quietly building empires of their own. For Michael Burry—the hedge fund manager who predicted the 2008 financial crisis and became immortalized in The Big Short—that moment seems to have arrived. His decision to deregister Scion Asset Management from the SEC marks more than an administrative change; it signals a deliberate shift in philosophy, one that every ambitious CEO and investor should pay attention to.

This isn’t a story about market bets or meme-worthy trades. It’s about power specifically, the kind that comes from controlling your own capital rather than collecting fees on someone else’s.

From Managing Capital to Owning It

In finance, there’s a world of difference between managing money and owning it. The former demands constant justification to clients, regulators, and quarterly performance reports; the latter offers freedom, focus, and long-term perspective.

Burry’s deregistration of Scion Asset Management effectively releases him from many of the structural obligations that come with running a traditional hedge fund. No more investor redemptions. No more reporting requirements for public filings. No more pressure to chase performance in sync with the S&P 500.

According to SEC data, Scion managed roughly $155 million across four accounts as of early 2025 tiny by hedge-fund standards but significant enough to serve as a personal capital base. In the same way that wealthy founders often pivot to family-office structures once their companies mature, Burry appears to be taking the same route: consolidating control, reducing exposure, and preparing for a more flexible investment horizon.

This approach isn’t unique to him. It echoes a growing trend among high-performing fund managers and entrepreneurs who’ve realized that true wealth creation doesn’t come from managing someone else’s risk—it comes from compounding one’s own.

The Economics of Autonomy

From a financial-strategy perspective, deregistration may seem counterintuitive. Hedge fund management offers consistent fee income, management control, and institutional clout. But the economics of autonomy can outweigh all three.

Running external capital imposes costs legal compliance, investor relations, administrative reporting that can eat into performance and limit agility. By contrast, private-capital structures enable tactical flexibility: direct investments, longer lockups, and the ability to pursue niche, uncorrelated bets.

This is especially relevant in a volatile macro environment, where liquidity and regulatory expectations can change in weeks. Burry’s move signals a belief that capital freedom not scale is now the ultimate hedge.

For CEOs, there’s a parallel lesson. Corporate growth models often mirror hedge funds: rapid scaling, investor oversight, and constant quarterly reporting. Yet at a certain level, scaling becomes constraint. Shifting from public growth to private control can reintroduce focus and restore strategic autonomy the same principle driving Burry’s transformation.

Legacy and the Architecture of Control

For Burry, control has always been a central theme. He built his early reputation not through size, but through conviction: his 2005 short positions on subprime mortgage bonds, taken against the grain of Wall Street optimism, reflected extraordinary independence of thought.

Now, two decades later, his structural shift represents that same mindset—only applied to his career rather than the market.

In essence, he’s rewriting what a “post-hedge-fund” career looks like. Instead of managing outside investors’ expectations, he’s consolidating his brand, reputation, and balance sheet into a single platform: himself. This type of consolidation isn’t just financial. It’s legacy building.

In corporate terms, it’s the equivalent of a founder buying back their own shares—reclaiming both ownership and narrative.

Lessons for business leaders

-

Autonomy Outperforms Scale. The capacity to act independently can often deliver higher compounded returns than chasing endless expansion.

-

Structure Shapes Outcome. How you own assets—or your company—determines the kind of risks you can take. Burry’s pivot illustrates the importance of governance structure in long-term wealth design.

-

Legacy Requires Design. Every business leader eventually faces a version of the same decision: continue managing others’ expectations, or build a structure that endures on your own terms.

These principles extend beyond finance. Whether you lead a global company, a private equity firm, or a family business, the underlying question is the same: do you control the capital, or does the capital control you?

The Next Frontier: Private Capital as Personal Strategy

Burry’s transition points to a wider financial trend. Family-office assets under management globally have surged past $6 trillion, according to UBS’s Global Family Office Report 2024. The motivation mirrors his: governance simplicity, agility, and strategic privacy.

As interest rates rise and asset valuations reset, we’re witnessing an inversion of the old hierarchy—where small, nimble pools of capital often outperform larger, bureaucratic ones. The future of elite investing may look less like Wall Street and more like private ownership circles where conviction, time, and control drive decisions.

In that sense, Burry isn’t retreating from finance. He’s simply moving up the pyramid—from fund manager to principal. From compliance to control.

Conclusion: The Quiet Power of Private Wealth

Michael Burry’s pivot offers a masterclass in business evolution. For years, he was known for calling bubbles and challenging herd behavior. Now he’s showing what it looks like to break free from the institutional machinery of finance itself.

For executives and investors watching from the sidelines, the message is clear: ownership isn’t just a financial position—it’s a leadership stance.

In an era obsessed with scale and exposure, Burry’s move reminds us that real power often lives in privacy, conviction, and control.

Frequently Asked Questions: Michael Burry and the Future of Private Capital

Why did Michael Burry deregister his hedge fund?

Deregistration allows him to manage his own capital without the regulatory burdens tied to external investors, giving him greater investment freedom and privacy.

Is this move common among other top investors?

Yes. Many veteran managers—including George Soros and Stanley Druckenmiller—eventually converted their funds into family-office structures to gain flexibility and preserve wealth.

What can business leaders learn from this?

The key lesson is strategic autonomy. Whether managing a fund or a company, the structure you operate under determines how free you are to execute your vision.