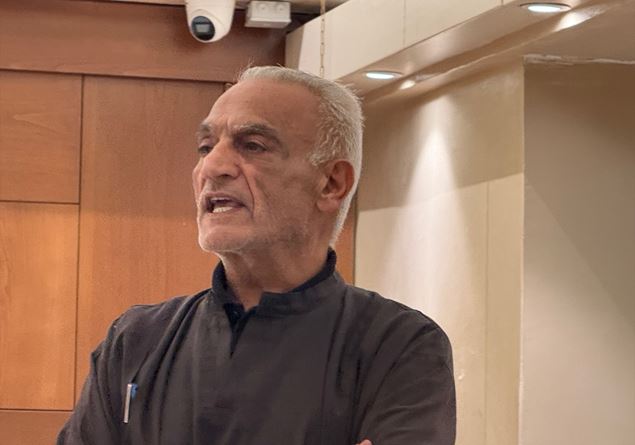

Paolo Savona.

Do you remember Pinocchio? With a metaphor taken by Collodi’s masterpiece, the president of Consob, Paolo Savona, in his seventh and final speech at the market, compared the boom in cryptocurrencies to the “field of miracles”, where “the illusion of easy earnings” hides systemic risks. The number one of the Authority, a liberal economist with a controversy and geopolitical gaze, has also focused on the “bank risk” of recent times, or the continuous merger of our credit institutions to the sound of public purchase offers (often hostile). A rather wild Risiko, more similar to a Far West, given that from the start of six offers for a value of 40 billion 52 exposed, which includes those of Mediobanca and Banco Bpm. A passage of his relationship also concerns the special powers of the government, the so -called “Golden Power”, which allows him to intervene when national strategic interests are at stake. Special powers in his opinion little coordinated with the rules of Brussels.

But let’s go back to the “field of miracles”, an ancient but effective metaphor of the credulity and the vacuous thirst for easy profit. Remember? The puppet burns its five gold coins, deceived by the cat and the fox in this ground (not far from the city “catcake-citrulli”) with the illusion that the next day is born a tree of sequins. Of course it will be robbed: there is no wealth without serious commitment. Unfortunately, cryptocurrencies, or digital coins not subject to interest rates, regulations and controls of central banks, continue to seduce many people as a means of easy profit. In reality, these are fluctuating currencies in very dangerous cyberspace, without guarantee, extremely volatile, not always exchangeable with traditional coins. Its real value runs on a daily roller coaster. Its use and its returns resemble chips of the casino. Not to mention the fraud and the Maxitruffe: “Exchange” platforms (where they can buy, sell and exchange) that suddenly disappear or suspend their activity, digital portfolios that volatilize into thin air, capitals that evaporate, managers who run away with the case, miserably failed investments, fraudulent bankruptcy that chasing each other. The prosecutor of Florence knows something about it, which continues to investigate various scams concerning tens of thousands of citizens for hundreds of millions of euros. The cat and the fox are back and speak in binary code.

But the president of the Authority in Piazza Affari goes further. “The analogy with the 2008 toxic titles crisis cannot escape,” he warned, highlighting how the Crypto operate “in the infosphere, escaping the territorial checks”. The solution? “We need cooperation between states, it is not enough to regulate private services.” Not only that, but Bitcoin, a source of continuous turbulence on the markets, end up destabilizing the traditional currency system, with all the consequences of the case. It is no mystery that euros and dollar suffer from the competition of these virtual money. How to counter? The speech becomes global, Savona has launched a revolutionary proposal: transforming the euro into a digital currency “to decentralized accounting, under control of the authorities”. A European “Safe-Saset” (which in practice means a good refuge, by drawers, such as the Gold Oi Bundes Germans) to “govern liquidity and contrast the competition of the Crypto”. The digital euro could become an international standard, he explained, “if the EU operators used it for exchanges”. A move to strengthen monetary sovereignty, also in light of the “protectionist moves of the USA”. Too bad that Trump goes in the opposite direction, having nominated Bitcoin and four other currencies for the US reserve, prohibiting the birth of the digital dollar. In practice, behind the Trump green ticket has placed the same cryptocurrencies, of which it personally has large quantities, in a conflict of phantasmagoric interests of which it seems that in America interests a few. The fact is that the only one who has really earned us on the cryptocurrencies so far is him: The Donald. He has already taken the case.