The Senate adopted an amendment to the draft budget for 2025 exempting from free transfer taxes donations of sums of money made within the family to finance the purchase or construction of a main residence, as well as works energy renovation in this one.

© Pixabay

– This includes donations to children, grandchildren, great-grandchildren or, in the absence of such descendants, to nephews and nieces.

-

To safeguard

Saved

Receive alerts Real estate purchase

Are you considering giving money to your children or grandchildren to help them acquire their first accommodation ? Good news, the senators adopted, this Friday, November 29, a amendment by Jean-François Husson, general rapporteur of the Senate Finance Committee, to the finance bill (PLF) for 2025 which “aims to exempt from free transfer rights donations of sums of money made within the family context”. Provided that these sums are allocated by the donee (the person who receives the donation) to the acquisition or construction of his main residenceor to finance work on energy renovation in his main residence.

This is a device “temporary and framed”, explained Jean-François Husson. Temporary because this exemption from free transfer taxes will concern donations made between January 1, 2025 and December 31, 2026. Framed because the donee must commit to keeping his or her main residence for three years and the exemption will apply in a limit of 100,000 euros. Please also note that donations to children, grandchildren, great-grandchildren or, in the absence of such descendants, to nephews and nieces are covered.

Notary fees on the rise: how much more will you have to pay for a purchase of €100,000?

Helping young people access property

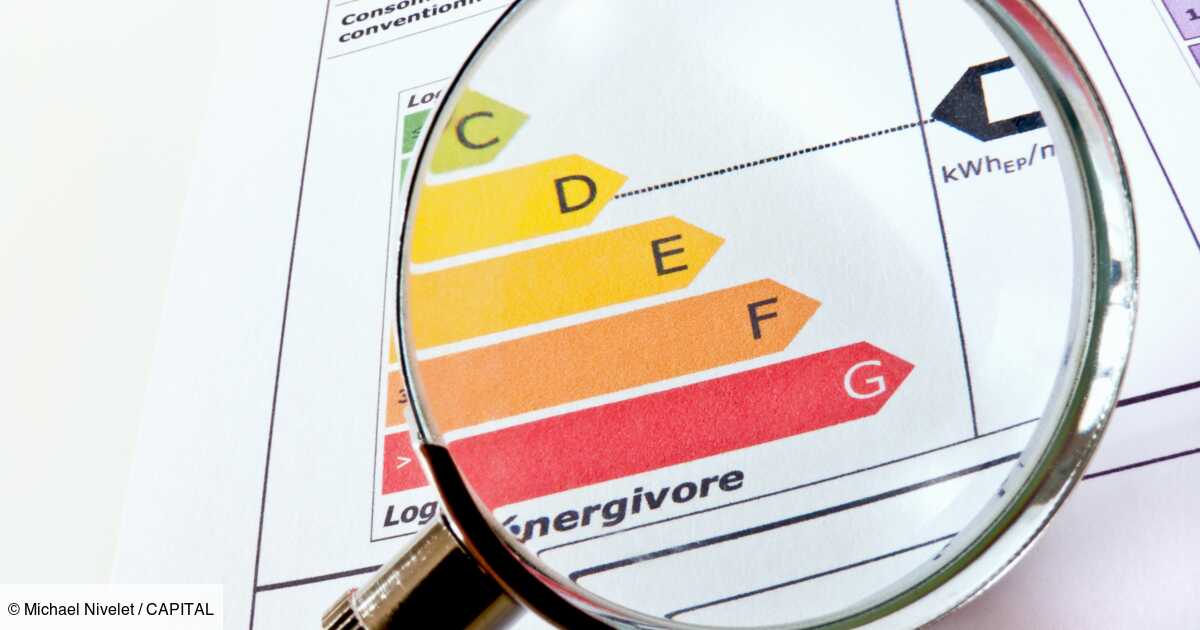

In a context “strained for accommodation”after more than two years of real estate crisis, Jean-François Husson thus intends “facilitate access to property, especially the youngest»penalized by credit rates still above 3% and by the difficulty of saving in order to build up a personal contribution. The senator also wants to give a boost to the renovation of thermal strainers, these housing units labeled G, F or E on the energy performance diagnosis and whose rental will be prohibited from 2025, 2028 and 2034, respectively.

This measure must still remain in the final version of the PLF 2025, on which the Senate must solemnly vote on December 12. Provided that senators and deputies agree on a common text, it will return for second reading to the National Assembly around December 18, before a possible recourse by the government to section 49.3 to have it adopted without a vote in Parliament. However, the Minister of Public Accounts, Laurent Saint-Martin, failed on Friday to have a government amendment adopted similar to that of Jean-François Husson but limited to new housing and only children and grandchildren.

Receive our latest news

Every week your appointment with real estate news.