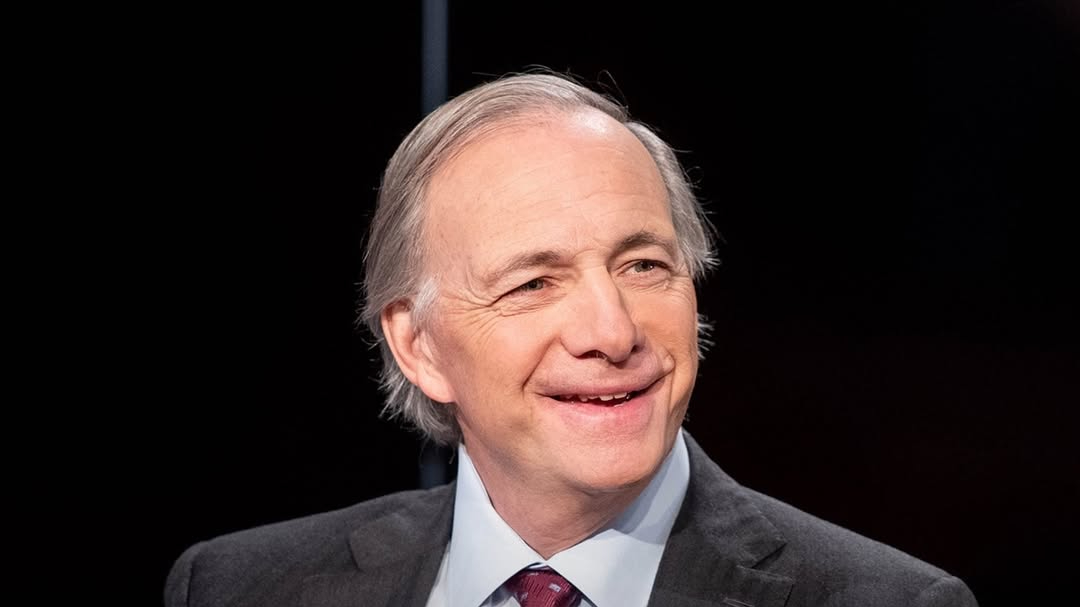

Ray Dalio’s Warning: The AI Bubble Is Real — But Don’t Panic Just Yet

Billionaire investor Ray Daliofounder of Bridgewater Associates, is issuing a measured warning: the stock market — particularly AI-driven stocks — appears to be in a bubble, but that doesn’t necessarily mean it’s time for investors to run for the exits.

A Familiar Tune: AI Boom Echoing the Dot-Com Era

Dalio argues that today’s AI rally bears striking resemblance to the late 1990s dot-com surge. In his view, the enthusiasm and sky-high valuations in AI are reminiscent of the heady days before the internet bubble burst. He believes that enthusiasm alone is not enough to cause a crash – the real danger comes when agents in the market are forced to raise cash, or when monetary policy tightens.

Why Dalio Believes the Pop Is Not Imminent

Contrary to the panic many expect, Dalio is not calling for an immediate sell-off. He highlights a few key reasons:

-

Monetary policy remains loose. Dalio argues that until the Federal Reserve reverses course on interest rates — from easing to tightening — the bubble may continue inflating.

-

Current liquidity supports the rally. With central banks injecting capital, risk assets continue to get a powerful tailwind.

-

Valuations are high, but not wildly irrational. Dalio points out that while some AI-related stocks are expensive, the broader market concentration and investor optimism are doing much of the heavy lifting right now.

The “80% Mark”: How Close Are We to a Burst?

To measure bubble risk, Dalio uses proprietary indicators: cash flows, leverage, sentiment, and wealth creation. Based on his model, he estimates the market could be approximately 80% of the way toward a full-blown peak but not quite at the brink.

He warns that it’s not the hype itself that pops bubbles: it’s the moment when investors need to liquidate. That moment often arrives because of policy shocks, leverage unwindings, or sudden liquidity stress.

Risks to Watch: What Could Trigger the downturn

Dalio identifies several possible catalysts that could prick the AI bubble:

-

A sharp shift in US monetary policy, such as interest rate hikes.

-

New taxes on wealth or windfall gains, particularly on the ultra-wealthy.

-

Rising leverage among market players, especially “weak hands” who may be forced to sell when conditions worsen.

-

Overreliance on AI valuations without underlying earnings to justify them, especially if monetization plans remain unclear.

Ray Dalio

His Advice for Investors: Vigilance, Not Despair

Dalio’s message is not to avoid stocks altogether but to remain vigilant. Here’s what he recommends:

-

Focus on timing, not just the presence of a bubble.

-

Avoid excessive leverage, particularly if your investment thesis relies on continued liquidity.

-

Diversify holdings across sectors — don’t be solely on AI.

-

Monitor macro policy closely, especially for signs that central banks might pivot.

-

Be ready for volatility: even if a crash isn’t near, sharp corrections are always possible.

Final Take: Enjoy the Ride — But Don’t Ignore the Warnings

Ray Dalio’s outlook is cautious, not panicked. He believes there’s more fuel in the tank thanks to easy money and investor confidence — but he doesn’t rule out the risk of a sharp deflation when trigger conditions align.

For now, his advice is clear: stay invested, but stay alert. The AI boom may continue, but so too does the risk that it is stretched — and when the music changes, those who rush for the exits may not all get out in time.