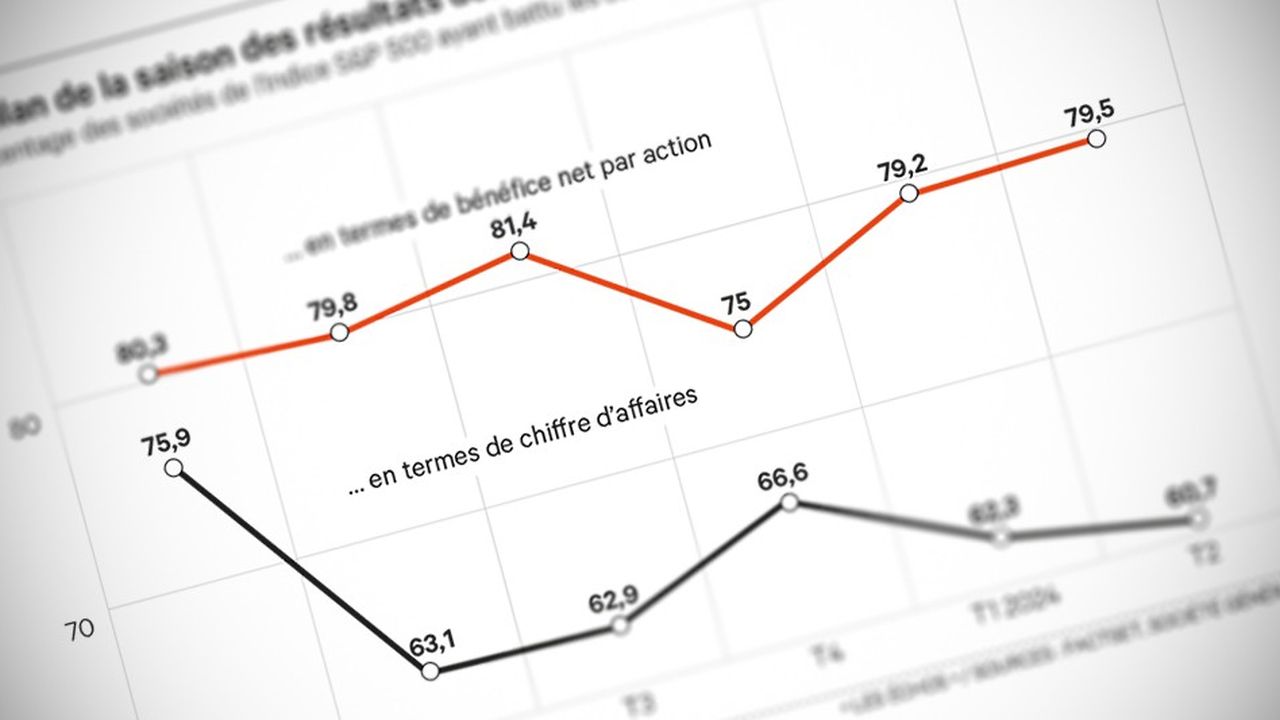

Nvidia closed out the quarterly earnings season with its perfect summary: numbers above expectations and a stock market penalty.

Earnings per share were better than expected in both the US (by 3.5%) and Europe (by 6%). As Manish Kabra, US equity strategist at Société Générale, points out, they firmly cement the S&P 500 index, which is slowly becoming desensitized to Big Tech against the backdrop of a robust economy.

In Europe, Deutsche Bank analysts note that stock market sentiment (4% negative on releases) has retained more bad news than good and has shifted optimism towards 2025. Overall, for 2024, the differential in earnings momentum has widened between the two continents (+10% for the S&P 500 and -2% for the Stoxx 600).

S&P 500 corporate earnings continued to surprise on the upside in the second quarter of 2024.FactSet, Societe Generale, Les Echos

Please note

Deutsche Bank analysts calculate that net earnings per share of the Stoxx 600 index returned to growth in the second quarter (+4% on average) for the first time since the first quarter of 2023 publications.

Although well above the 2% drop expected by the consensus, these figures have not improved brokers’ vision for 2024, who have revised downwards their forecasts for the second half.

The German bank notes that the lowering of annual targets was fairly clearly punished by the stock market (-4.3% in median reaction for the titles) while the increases were more weakly rewarded (+2.1%). The reception was similar for the results (+0.8% in median reaction for the good surprises, and -1.4% for the bad ones).