Buy your main residence or stay a tenant? Many French people ask themselves this question. To help them in their real estate projects, MeilleurTaux carries out a study each year aimed at determining the moment when the purchase of a main residence becomes more advantageous than renting. This study, which looks at 32 cities in France, is based on housing with a surface area of 70 m2. Several criteria are taken into account, whether for purchase or rental. Among them: the price per m2, the amount of property tax, charges, the amount of rent, the return on money invested, etc.

Good news: thanks to the gradual drop in interest rates (currently 3.4% over 25 years), and the rebalancing of property prices, the French are finding favorable purchasing prospects again. From now on, the average duration to make the acquisition of a main residence profitable compared to remaining a tenant is 12 years and 3 months, versus 14 years and 8 months in 2024. “Among the 32 cities analyzed, the duration to make your purchase profitable fell in 24 of them, or two thirds», indicates MeilleurTaux. And for some cities, this drop is far from negligible.

Here are the Top 10 cities where profitability is the fastest :

- Mulhouse : 19 months (+4 months compared to 2024)

- Saint-Etienne : 25 months (- 29 months)

- Limoges : 51 months (+ 1 month)

- Le Havre : 55 months (- 30 months)

- Perpignan : 64 months (- 14 months)

- Metz : 69 months (- 42 months)

- Grenoble : 83 months (- 109 months)

- Clermont-Ferrand : 89 months (- 37 months)

- Rouen : 91 months (- 77 months)

- Brest : 93 months (- 15 months)

In other words, French people who plan to settle for more than 19 months (1 year and 7 months) in Mulhouse have every interest in choosing to buy rather than rent. This is partly due to the low cost of real estate: 1,259 euros/m2 in 2025, according to MeilleurTaux. In Saint-Etienne, the change is also rapid: it is after 25 months (2 years and 1 month) that buying your main residence becomes more profitable than renting it. Even if the property tax is high there (1,452 euros for a 70 m2), the price per m2 remains attractive: 1,226 euros on average in 2025. Finally, in Limoges, it is in 51 months (i.e. 4 years and 3 months) that buyers can hope to make their investment profitable.

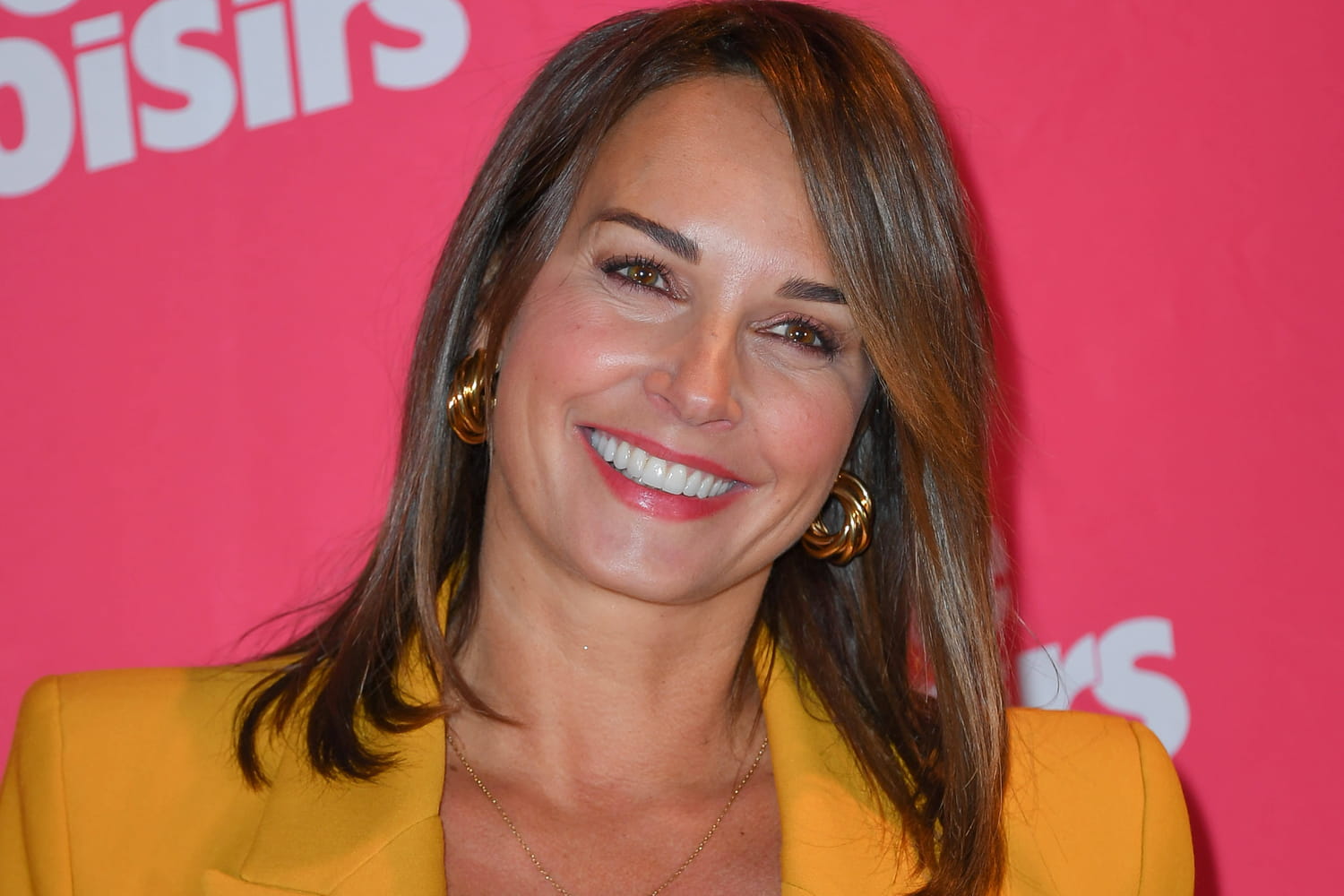

Conversely, there remain certain cities – the most expensive – where it takes a long time to make your purchase profitable. This is for example the case of Paris, Aix-en-Provence, Nice and Bordeaux, where this duration is greater than 18 years. “In certain metropolises, high prices, local taxation or rent controls lengthen the duration and can encourage rental over long periods.», deciphers Aga Bojarska-Serres, credit director at MeilleurTaux. In Aix-en-Provence, for example, it takes 268 months (22 years and 4 months) to amortize the purchase of real estate while it takes 253 months (21 years and 1 month) in Paris. Buying is less attractive here than renting.

>> Our service – Save money by testing our home loan insurance comparator