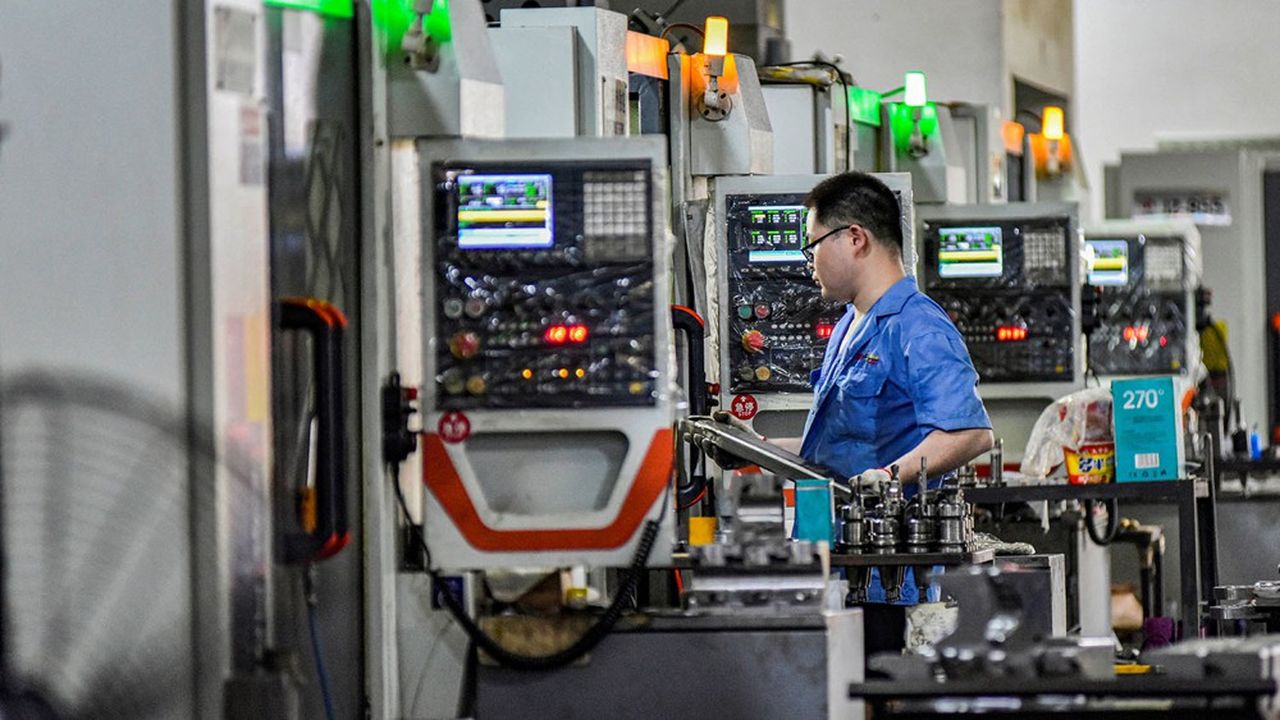

This is not the end of the crisis, but the beginning of an improvement for Chinese factories. Manufacturing activity in China recovered slightly in August, according to the latest PMI index compiled by Caixin and S&P Global, published on Monday. Over the period, this indicator – which gives a monthly snapshot of Chinese production and is based on a survey of 650 private and public manufacturers – reached 50.4 compared to 49.8 in July.

It has thus exceeded the 50 mark, which separates a contraction from a recovery in manufacturing activity. A return to positive territory which signals “an improvement in market conditions” according to Wang Zhe, senior economist at Caixin Insight Group.

Chinese factories have been driven by new domestic orders, which have returned to growth. This is particularly the case in consumer goods and intermediate products companies. The summer period, with millions of Chinese children on vacation, combined with the promotions launched by many brands to try to revive consumption, seems to have played a role.

The improvement has allowed Chinese factories to stabilize their workforce, while employment in the industry has been falling for 11 months in a row in the country, according to the economic media Caixin. Faced with demand, some industries have even had to recruit – more or less in proportion to those that have had to lay off workers.

Trade war

On the other hand, this sector – a quarter of the country’s GDP – remains weighed down by the fall in external demand, while the European Union and China are engaged in a trade war that ranges from electric vehicles to cognac to pork. Thus, the Caixin subindex that tracks exports fell for the first time in eight months, falling below the 50 mark. At the same time, prices in industry continue to fall, raising fears of a deflationary spiral in the sector. And Chinese factories have also been penalized by very strong heat waves, which have slowed delivery times.

Overall, the context therefore remains difficult for Chinese industry. The “official” PMI, compiled by the National Bureau of Statistics, still shows a contraction: it stood at 49.1 in August compared to 49.4 in July, below the forecasts of the Bloomberg agency which was counting on 49.5. Outside of industry, on the other hand, the non-manufacturing PMI (which measures the state of the market in construction and services) increased slightly, going from 50.2 in July to 50.3 in August, notably thanks to tourism this summer. Overall, however, the composite PMI (which tracks industry and services) declined slightly, going from 50.3 in July to 50.2 in August.

Support measures

In this context, many observers are calling for large-scale support measures, while China’s GDP grew by only 4.7% in the second quarter, below forecasts. However, in July, the third plenum of the Central Committee of the Communist Party of China (CPC), traditionally devoted to the economy, did not result in major reforms to revive the economy.

“There is still room for fiscal and monetary adjustments,” said Wang Zhe of Caixin. “To avoid a major slowdown, policy support is urgently needed in our view,” said Citi. “But we do not anticipate a major stimulus, at least not before the US elections.”