By Nicolas Goetzmann (chief economist of Financière de la Cité, columnist for “Les Echos”)

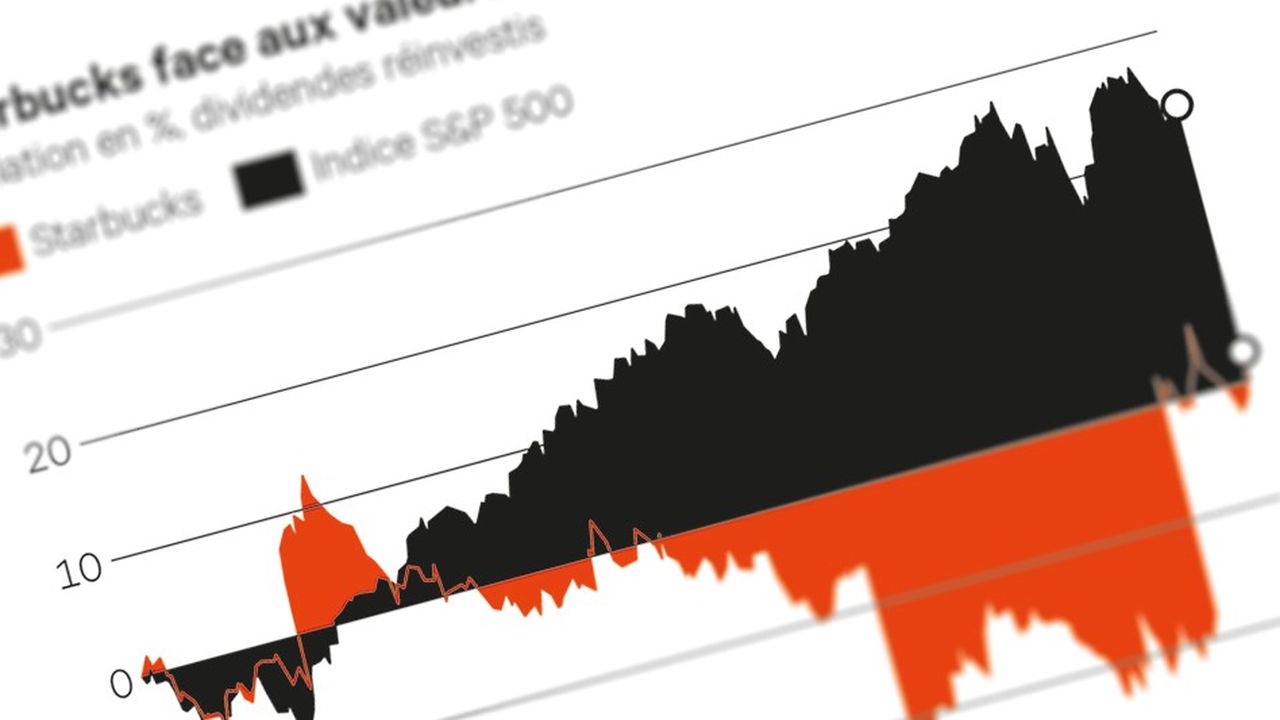

According to data published by the European Central Bank, the “daily nominal effective exchange rate of the euro” (value of the euro compared to a basket of currencies representative of the zone’s trade) recorded its highest historical level on Thursday 22 August, definitively sweeping away its peaks recorded during the great financial crisis of 2008.

This record is somewhat surprising. While the ECB had chosen to make its first rate cut on June 6, the US Federal Reserve will not do the same until September 18, which marks a delay that could have been unfavorable to the value of the single currency. By lowering its rates before those of the Fed, the ECB was also worried about seeing investors desert the euro in favor of currencies delivering a higher income. But the opposite happened.