Top Crypto Billionaires Shaping 2025’s Wealth

Crypto Billionaires 2025: Inside the Fortunes Shaping Digital Finance

Cryptocurrency has evolved from a niche experiment into a trillion-dollar industry and in its wake, a new class of billionaires has emerged. From Binance’s Changpeng Zhao to Coinbase’s Brian Armstrong and MicroStrategy’s Michael Saylor, these visionaries have turned volatility into opportunity, building empires that challenge traditional banking, tech, and regulation.

But as digital wealth grows, so does global scrutiny. With governments tightening controls on crypto markets, the world’s richest crypto leaders now sit at the intersection of innovation, finance, and law.

Changpeng Zhao: The Architect of Binance’s Empire

Once a coder, now a crypto titan, Changpeng “CZ” Zhao built Binance into the world’s largest exchange reaching profitability within 90 days of launch in 2017. But his journey hasn’t been without controversy.

In 2023, Zhao pleaded guilty to US anti-money laundering violations and stepped down as CEO in a landmark settlement that saw Binance pay $4.3 billion in fines. Despite this, Zhao remains the majority owner believed to hold 90% of Binance, and commands a net worth of roughly $45 billion.

Under his watch, Binance surpassed 250 million registered users by late 2024. The exchange’s resilience after legal turmoil shows how deeply ingrained crypto trading has become in the global financial system.

Brian Armstrong: The Institutional Face of Crypto

Brian Armstrong, co-founder and CEO of Coinbase, has become the face of crypto’s push toward legitimacy. His company’s 2021 NASDAQ debut marked a turning point for digital assets, symbolizing crypto’s arrival on Wall Street.

Armstrong, who owns about 13% of Coinbase, has an estimated net worth of $15 billion, according to Forbes. His approach to compliance contrasts sharply with Zhao’s, emphasizing transparency and regulation as crypto’s foundation for growth.

In an interview with The Financial TimesArmstrong said, “Crypto must be the most trusted industry in the world if it’s to transform finance.” With a market cap of $89 billion, Coinbase is now one of the largest publicly traded financial platforms in the US

Brian Armstrong

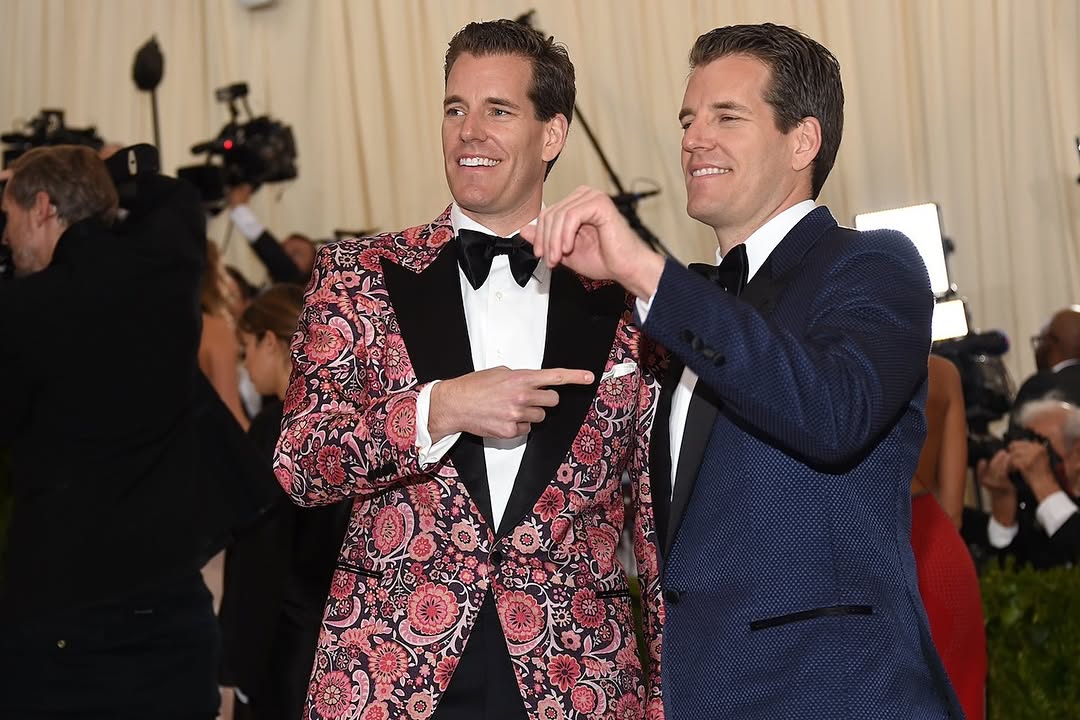

The Winklevoss Twins: From Facebook Feud to Financial Freedom

Few redemption stories rival that of Cameron and Tyler Winklevoss, the Harvard rowers who famously sued Mark Zuckerberg over Facebook’s creation. Their $65 million settlement became seed capital for a bet on Bitcoin $11 million invested in 2012, when a coin was worth just $120.

That gamble paid off: they became the first publicly known Bitcoin billionaires in 2017. Today, through their regulated exchange Gemini, they promote a safer, compliant version of crypto finance. Their combined fortune is estimated at $13.7 billion, according to Forbes.

The twins’ pivot from social networking to blockchain solidified their place as early visionaries who saw crypto as the future of open finance.

The Winklevoss Twins

Giancarlo Devasini: The Quiet Power Behind Tether

Behind the world’s most traded cryptocurrency isn’t a Bitcoin miner or tech founder, it’s Giancarlo Devasini, an Italian former plastic surgeon turned crypto mogul. As co-founder and chairman of Tether, Devasini oversees the $100 billion stablecoin USDT, which underpins global crypto liquidity.

According to Forbeshe owns 47% of Tether, giving him a net worth of $11.5 billion. Despite criticism over reserve transparency, Devasini insists that Tether maintains “the strongest liquidity position in digital finance.”

Tether’s role as the backbone of crypto trading facilitating trillions in monthly transactions places Devasini among the most influential yet enigmatic figures in modern finance.

Giancarlo Devasini

Michael Saylor: The Bitcoin Evangelist

Michael Saylor, co-founder and executive chairman of Strategy (formerly MicroStrategy), turned a software company into a corporate Bitcoin powerhouse. The company holds 597,325 bitcoins, acquired at an average price of $70,982, according to its June 2025 filing making it the largest publicly known Bitcoin holder.

Saylor’s net worth sits around $8.3 billion, fueled by Bitcoin’s 2024 surge that sent Strategy’s stock soaring nearly 700%. He has described Bitcoin as “the ultimate hedge against inflation and monetary instability.”

While critics call his approach reckless, Saylor has become a de facto ambassador for institutional Bitcoin investment, blending corporate governance with crypto conviction.

Michael Saylor

Crypto Wealth Meets Regulation: The New Financial Frontier

These billionaires represent more than personal success stories — they embody crypto’s global transformation. But as digital assets infiltrate mainstream finance, they are colliding with complex regulatory frameworks and legal oversight. Central to their empires are cryptocurrency wallets the digital vaults that store and secure billions in Bitcoin, Ethereum, and other assets. From cold wallets used for maximum security to hot wallets enabling instant global trades, these tools are the backbone of modern crypto wealth management.

According to PwC’s Global Crypto Outlook 202538% of institutional investors now hold digital assets, up from 21% in 2023. Yet with this growth comes accountability. Governments from the US Treasury to the European Central Bank are crafting stricter frameworks to police exchanges, stablecoins, and cross-border transactions.

Legal experts say this shift marks the next phase in crypto’s evolution. As Jake Chervinsky, Chief Legal Officer at Variant Fund, told CoinDesk“Crypto wealth has moved from the shadows to the spotlight. In this new era, compliance will determine who remains on top.”

The Next Era of Digital Billionaires

From underground forums to the boardrooms of Wall Street, crypto’s pioneers have rewritten the rules of global wealth. Yet as markets mature and governments assert control, the balance between innovation and regulation will define the next generation of crypto billionaires.

Whether through Bitcoin, DeFi, or tokenized assets, one thing is clear: the line between traditional finance and digital power is no longer visible, it’s been merged into one global economy.