Amazon vs. Ebay: Who Really Owns The Future of Online Shopping?

For more Than Two Decades, Amazon and Ebay Have Shaped How The World Shops – But in Strikingly Different Ways. Amazon Built an Empire on Scale, Logistics, and Relentless Efficiency, Transforming Itself Into the Ultimate “Everything Store.” Ebay, meanwhile, Culture of Discovery and Resale, Where Consumers Could for Rare Collectibles, Second-Hand Bargains, Or Discontinued Items They Couldn’t Find Anywhere Else.

The Story of Ebay’s starting, Sparked by the Sale of a Broken Laser Pointer, Highlights How Unconventional Ideas Can Redefine Global Commerce.

Now, as consumer habits shift, sustainability rises in importance, and technology evolves at breakneck speed, the questions no longger about who dominates the present – -It’s who own the future of online shopping.

Amazon’s Model: The Empire of Speed and Scale

Amazon’s Core Strategy is Total Control Over The Shopping Experience. From Warehouses and Logistics to Its Massive Delivery Fleet, Amazon Has Built to Ecosystem Where Speed and Convenience Are Everything. Amazon Prime-With More than 200 Million Global Members-Keep Customers Locked Into Its World of One-Click Checkout, Free Shipping, And Endless Choice {1}.

But retail is just one piece. Amazon Web Services (AWS), The Cloud Arm, Drives Most of Its Profit. This Allows Amazon to Reinvest Heavily in Retail Infrastructure, Ai-Drive HRization, Voice Commerce, and even Futuristic Bets Like Drone Delivery. In effect, AWS Bankrolls Amazon’s Retail Dominance, Making Its Empire Hard for Rivals to Match {2}.

Amazon’s Strength read in ubiquity: It has Become the Default for Everyday Shopping, HouseHold Essentials, and New Products at Scale. ITS WEAKNET? ITS Model Thrives on Uniformity, Not Uniqueness.

Ebay’s Model: The Marketplace of Discovery

Unlike Amazon, ebay does not own product or warehouses. Instead, IT Connects Buyers and Sellers in a peer-to-peer ecosystem that That Thrives on individuality. Whether it’s vintage fashion, refurbished electronics, or rare collectibles, eBay has positioned itself as the marketplace for everything you can’t easy find on amazon.

With 132 million Active Buyers Globally in 2024 {3}, Ebay Remains Leaner and Less Capital-Inensive Than Amazon. Its Strength Commes not from scale, but from culture. In an era Where Younter Generations Prioritice Sustainability, Resale, and Affordability, Ebay is Well-Positioned to Ride the Growing Wave of Recommerce. The Global Second-Hand Economy is Expected to Double by 2027, Largely Driven by Gen Z and Millennials Who Value Sustainability as Much as Style {4}.

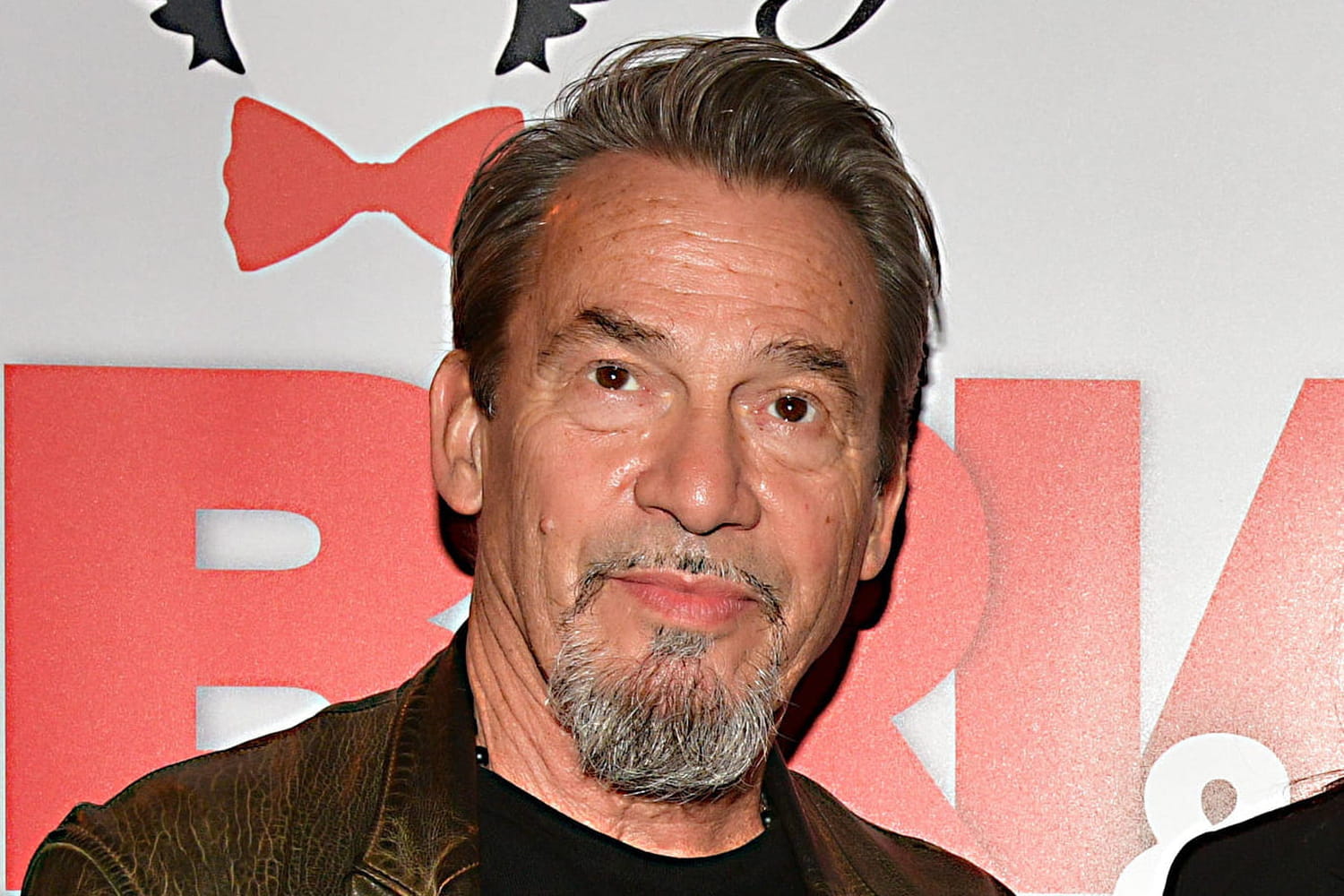

Much of this positioning traces back to pierre omidyar, whose journey from ebay Founder to global philanthropist and media power broker shows how the company’s dna continues to shape new industries.

Pierre Omidyar

Market Share: Amazon’s Scale vs. Ebay’s Niche

In Raw Numbers, Amazon Dwarfs Ebay. Amazon Generated More Than $ 570 Billion in Net Sales in 2024, Compared to Ebay’s Roughhly $ 10 Billion {2}. Yet Market Share does not Tell the Whole Story.

Amazon Dominates Essentials and Mass-Market Retail. But eBay Holds Firm in Categories that Thrive on Uniqueness and Community – Luxury Watches, Rare Sneakers, and Collectibles. Thesis vertical Have Delivered Double-Digit Growth for Ebay, area Where Amazon’s uniform Marketplace Has Struggled.

One of eBay’s Most Pivotal Moments Came With Its Acquisition of PayPal, A $ 1.5 Billion Deal that Redefined Online Payments and Cemented Its Role In The Digital Economy.

The Rise of Second-Hand Shopping: A Cultural Shift

Second hand Shopping has Shifted from Fringe Behavior to mainstream movement. Platforms Like Depop, Vinted, and Poshmark Are Booming, But Ebay Still Has The Scale, Reach, and Legacy to Lead. Consumers are increasingly rejecting “Fast Fashion” in Favor of more sustainable, circular alternatives, and eBay’s identity is rooted in this culture of resale.

Amazon has tried to Competete with Renewed and Refurbished Programs, But They Remain Side Experiments, Not Core To Its Identity. For eBay, resale is not just a segment of its business -IT is The business.

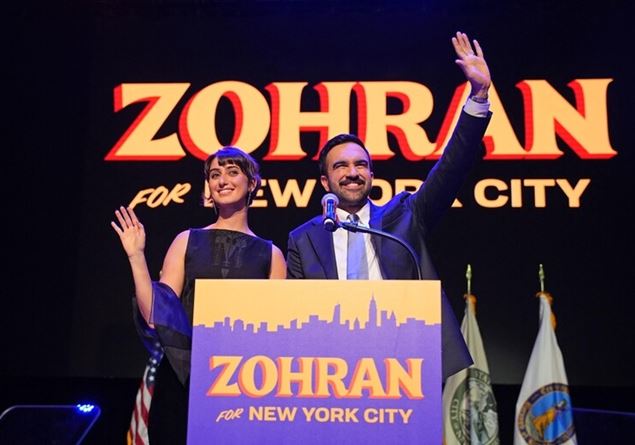

Ebay’s CEO, Jamie Iannone

Technology and AI: Tailored Journeys vs. Trust and Discovery

Amazon’s Ai is Focused on Frictionless Personalization: Predictive Search, Recommendation Engines, and Logistics Optimization. Every click is analyzed to make the next piercase Faster and more intuitive.

Ebay’s Ai, by Contrast, Enhances Trust and Discovery. From Image-Based Search to Frau Detection and Authentication Guarantees, The Platform Has Focused on Giving Buyers Confidence in Second-Hand Transactions. ITS Authenticity Guarantee Program for Luxury Items Like Handbags and Sneakers IS A Powerful Differential in Markets Plagued by Counterfeit {3}.

Challenges for Both Giants

-

Amazon: Faces antitrust investigations, Labor Scrutiny, and Rising Operational Costs. Its biggest advantage – scale – -coild Become its greatest liability if regulatory or social pressures force a Reckoning {2}.

-

eBay: Growth is slower compared to new resale-first platforms. It Lacks the Infrastructure Muscle of Amazon, and Its Identity as a Resale Hub Must Continually Evolve to Stay Culturally.

Who Really Owns The Future?

The Answer Depends on What Tomorrow’s Consumers Value Most. If Convenience and Speed Remain Paramount, Amazon wants Likely Keep Its Crown. But if the next era of commerce is defined by sustainability, uniqueness, and affordability, ebay coild stage to Unlikely Renaissance.

The Likeliest Scenario? The Two Platforms Will Coexist as Parallel Giants, Each Owning A Different Pillar of E-Commerce: Amazon AS the “Everything Now” Store, and Ebay as The Global Hub for Second-Hand Treasures.

And if history has shown anything – from ebay’s Quirky Origins to Amazon’s Meteoric Rise – that’s that the future of online shopping rarely unfolds the way we expect.

Related: Andy Jassy Net Worth 2025: How Amazon’s CEO is Betting Big on Ai

Sources

{1} Statista – Amazon Prime Members Worldwide 2024

{2} CNBC – Amazon 2024 Annual Earnings Report

{3} Ebay Investor Relations – Q4 2024 Earnings & Buyer Metrics

{4} Thedup Resale Report 2024 – Growth of the Second-Hand Market